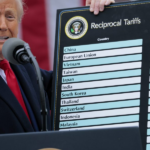

Jerome Powell, chairman of the Federal Reserve, has admitted that trade tariffs set by U.S. President Donald Trump could increase inflation and slow down economic expansion. Although financial markets have mostly factored in these consequences, Powell’s comments emphasise that such events have policy relevance.

UBS analyst Paul Donovan claims Powell emphasised longer-term inflation forecasts as a more consistent gauge than short-term mood. Though more than a third of U.S. consumers (according to sentiment surveys) anticipate inflation exceeding 10% this year—a number Donovan says is based on questionable data—Powell argued that the general inflation forecast still favours the chance of interest rate reductions. The Fed might restrict the degree of those cuts, though, since this decline is mostly self-inflicted.

Trump’s trade strategies come back into play as talks with Japan move forward.

President Trump’s revived emphasis on trade talks with Japan is attracting notice. Attending continuous trade negotiations, Trump spoke of the possibility of a “big deal,” which markets are reading as a signal of likely retreat or concession. Japan’s most recent trade statistics reveal that imbalances related to an ageing population are not very concerning, suggesting Trump’s attitude might reflect old 1980s-era economic worries.

Lagarde vs. Powell under the spotlight, ECB Poised for Rate Cut

Consensus among 62 experts suggests the European Central Bank will reduce interest rates. Particularly given the European economy is probably going to suffer less from Trump’s tariff plans than the U.S., comparing the tone of ECB President Christine Lagarde to Powell’s could provide insight.

Though they are unreliable, sentiment surveys have an effect.

The most recent U.S. Philly Fed business sentiment survey is also being awaited by markets. Investors keep a careful eye on such reports even if many doubt the dependability of present mood data. Policy uncertainty has made many businesses wary; even dubious data is significantly affecting this economic uncertainty.