Berkshire Hathaway lead director Sue Decker said the heir to CEO Warren Buffett’s throne is already transitioning into the top spot.

Berkshire Hathaway Energy CEO Greg Abel is set to take over Buffett’s role as chief executive of the overall conglomerate.

She added, “We don’t even really see him as a CEO in waiting, he’s taking on the leadership capacity right now.”

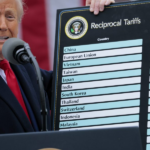

The Q&A will also give him an opportunity to comment on the recent market volatility since President Donald Trump announced his so-called “Liberation Day” tariffs on April 2. That includes a 145% tariff on Chinese imports, though he has made key exceptions and put duties elsewhere on a 90-day hold.

Investors are hoping for something more forceful this weekend.

It’s unclear if Buffett will make any statements on the market outlook in relation to tariffs, but his recent capital movements have suggested he’s safeguarding Berkshire from a possible economic downturn.

When asked about why Berkshire is carrying so much cash, Decker said that the company doesn’t see cash as “sitting there idle, we see it as a strategic asset.”

“When you think about what’s going on right now in the world, there’s really no other company in the world that has a fortress of a balance sheet that also could be used to help stabilize or provide liquidity if some major financial market dislocation happened,” she told CNBC.