Advanced Micro Devices (NASDAQ: AMD) witnessed another day of robust gains in Friday’s trading session, with the semiconductor company’s share price closing 5.3% higher, according to data from S&P Global Market Intelligence.

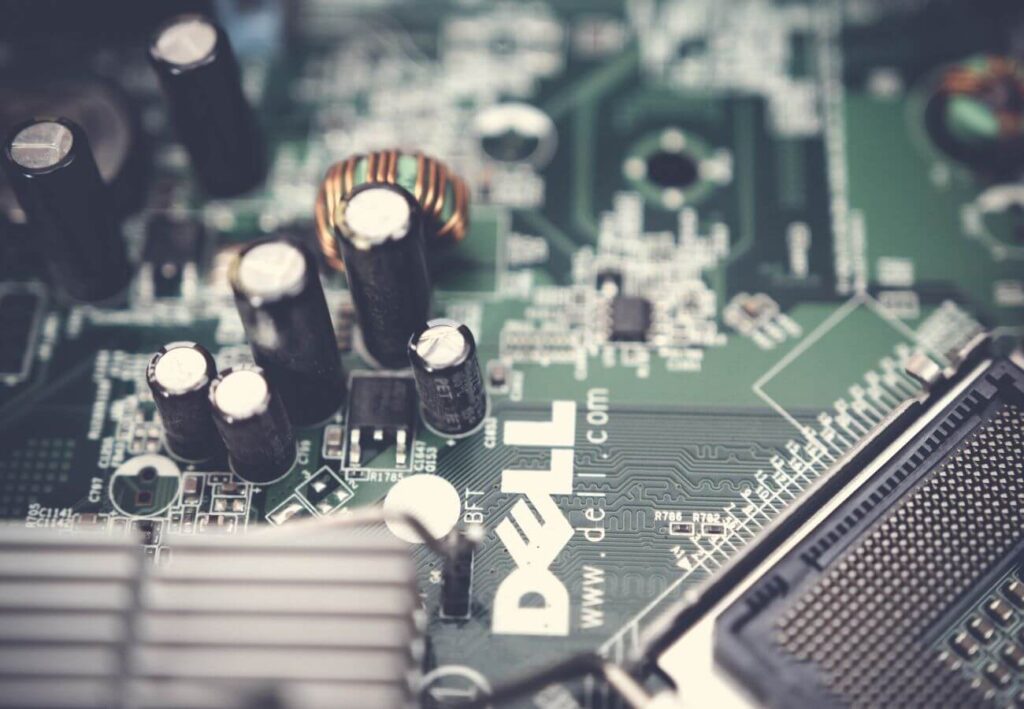

Despite the absence of specific news concerning AMD, its stock price surged alongside optimistic indicators for AI demand and growth prospects. Dell’s fourth-quarter report, released after Thursday’s market close, served as the latest bullish catalyst for AI-related stocks.

Dell’s Q4 results exceeded expectations, with non-GAAP earnings of $2.20 per share on sales of $22.3 billion, surpassing analysts’ estimates. Particularly encouraging was the strong demand for Dell’s AI server products, with the company anticipating this trend to fuel robust performance through 2025.

The substantial increase in Dell’s stock price by 31.6% on Friday had a ripple effect on the valuations of leading AI players, including AMD. AMD’s stock has seen a remarkable ascent, climbing 37.5% year-to-date and 158% over the past year.

Looking ahead, the future trajectory of AMD stock remains promising amid growing enthusiasm about the company’s AI-related opportunities. Despite trading at relatively high multiples—55.7 times this year’s expected earnings and 37 times next year’s projected profits—investors are optimistic about AMD’s growth prospects.

AMD’s first-quarter midpoint guidance indicates sales of approximately $5.4 billion, with sales expected to remain relatively flat year-over-year. While AMD has not yet experienced a significant surge in sales and earnings from AI processor sales compared to its competitor Nvidia, market sentiment remains bullish regarding future growth acceleration.