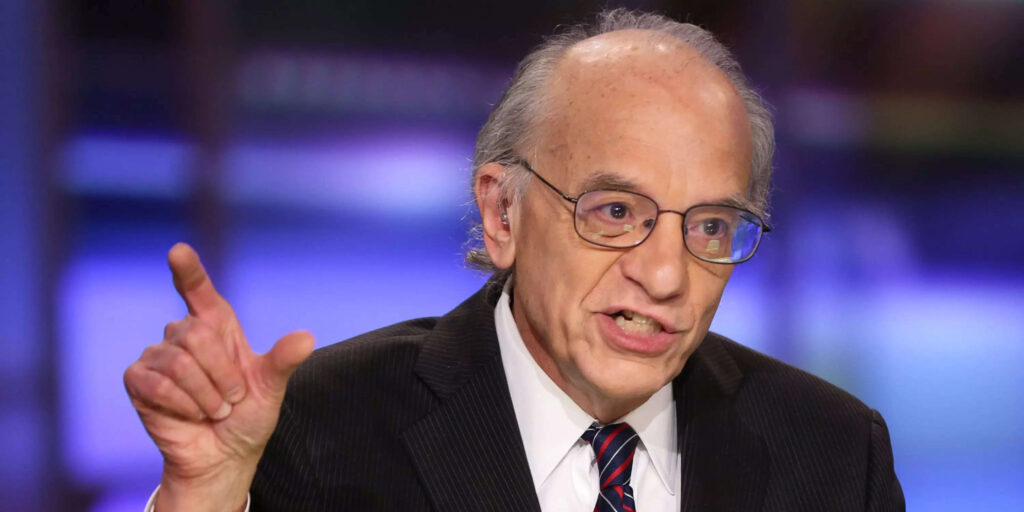

As the stock market approaches potential all-time highs, Wharton’s Jeremy Siegel raises a red flag, suggesting that Federal Reserve Chairman Jerome Powell’s stance on inflation could be the only impediment to the market’s surge. Despite optimistic signals and expectations of the S&P 500 reaching 4,700 in 2024, Siegel warns that the Fed’s commitment to a 2% inflation target may hinder further gains.

Siegel, a renowned stock analyst, has consistently urged Powell to adopt a more flexible approach to rate hikes. In his recent commentary on Wisdom Tree, Siegel reiterated the need for moderation in the central bank’s policies, particularly in the face of the Dow Jones approaching an all-time high.

While the Dow Jones has experienced a 9.2% gain year-to-date, reaching 36,204, Siegel believes the Federal Reserve’s unwavering focus on inflation fears could be a potential stumbling block. He cautions that the primary risk to the market’s upward trajectory is a Fed that remains fixated on inflation concerns.

Despite Powell’s assurance of the Fed’s commitment to the 2% inflation target, Siegel notes the chairman’s recent comments hinting at a more cautious approach. Powell acknowledged the risks of under- and over-tightening and signaled a careful forward movement for the Fed.

Siegel concludes that, given Powell’s recent statements, there might not be a rate hike at the next meeting. He emphasizes that the current Powell-led Fed prefers not to surprise the markets, and any intention to hike rates would have been signaled to the market during Powell’s recent speech.

Looking ahead, murmurs of potential rate cuts in 2024 are circulating in the market, with various analysts offering differing timelines. Goldman Sachs estimates a rate cut in Q4 2024, Bank of America predicts mid-2024, and Citi anticipates 100 basis points of rate cuts throughout the year. However, Siegel remains cautious, stating that the timing of cuts depends on economic data and inflation trends.

He cautions investors as they enter the new year, advising vigilance amid discussions about Fed rate hikes or cuts, especially after the release of the Dot Plot in December. Siegel notes the potential for social media commentary on the hawkish tone of the Dot Plot and reminds investors of the Fed’s historical forecasting record.