Wall Street saw a down day yesterday, with major indexes closing lower on anxieties surrounding rising interest rates and climbing bond yields. This comes after a period of relative calm in the market, fueled by hopes of potential interest rate cuts from the Federal Reserve later this year.

The primary concern for investors appears to be the timing and extent of these anticipated cuts. Recent economic data, including strong consumer confidence figures, has cast doubt on the immediate need for such measures. This has led to a rise in Treasury yields, directly competing with stocks for investor capital. Higher yields make bonds a more attractive option, potentially pulling investment away from the stock market.

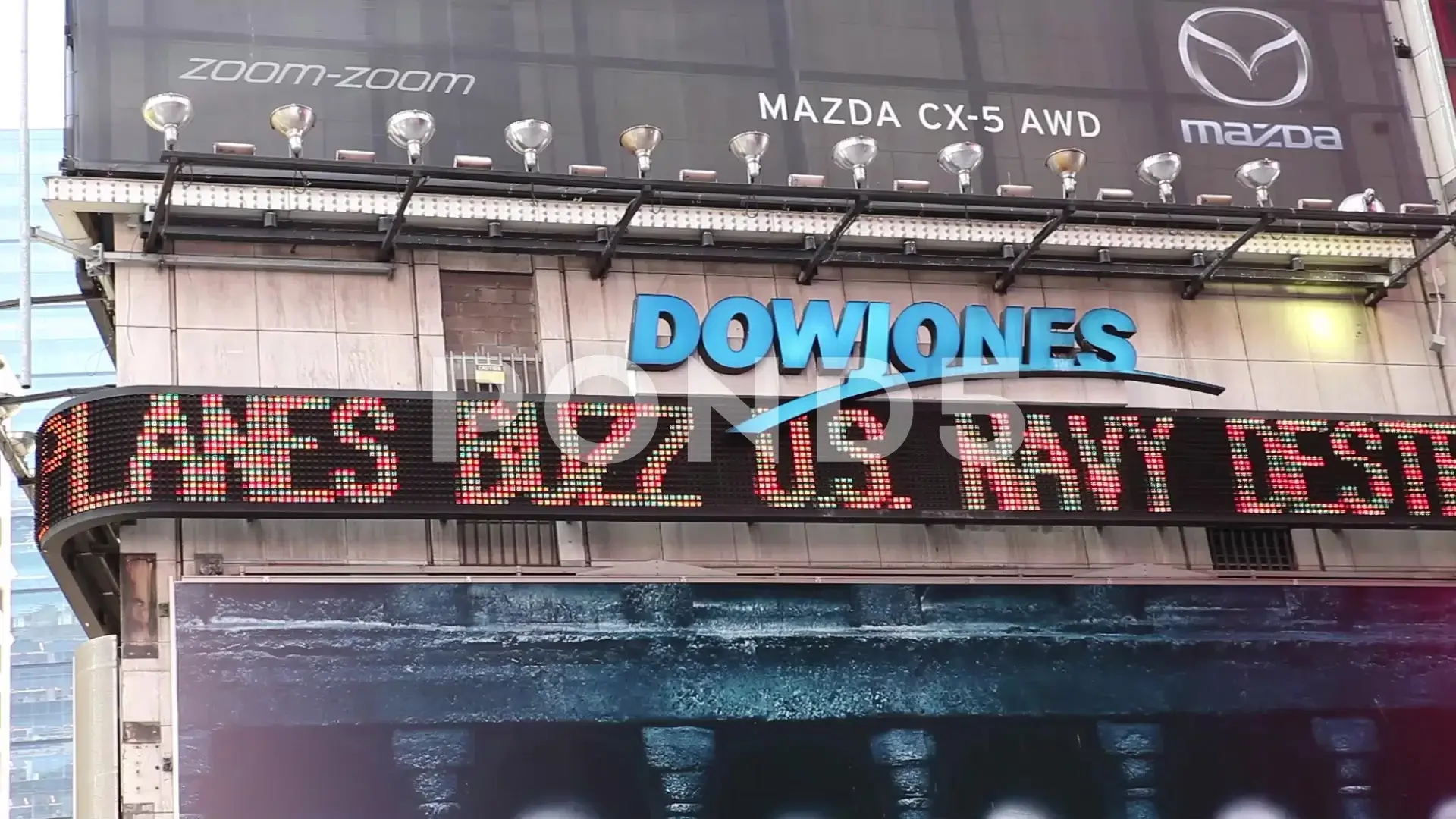

The Dow Jones Industrial Average fell more than 1%, reaching its lowest level in nearly a month. The S&P 500 and Nasdaq Composite also experienced losses, with all major sectors in the red. Technology giants, typically sensitive to interest rate fluctuations, were among the decliners.

This market dip reflects the ongoing uncertainty surrounding the Federal Reserve’s monetary policy.

While inflation has shown signs of cooling compared to its peak in mid-2022, it remains above the Fed’s target of 2%. This, coupled with hawkish comments from central bankers, has tempered expectations for significant rate cuts. Investors are now anticipating a more cautious approach from the Fed, with potentially only one cut by the end of the year, as opposed to the multiple cuts initially hoped for.

The coming days and weeks will be crucial in gauging the Fed’s stance and its impact on the market. Investors will be closely watching for further economic data releases and any signals from the Fed regarding its future policy decisions.