Now that trade deals have been clinched with the European Union and Japan, the U.S. looks to focus on China as the world’s two biggest economies prepare for high-stakes talks.

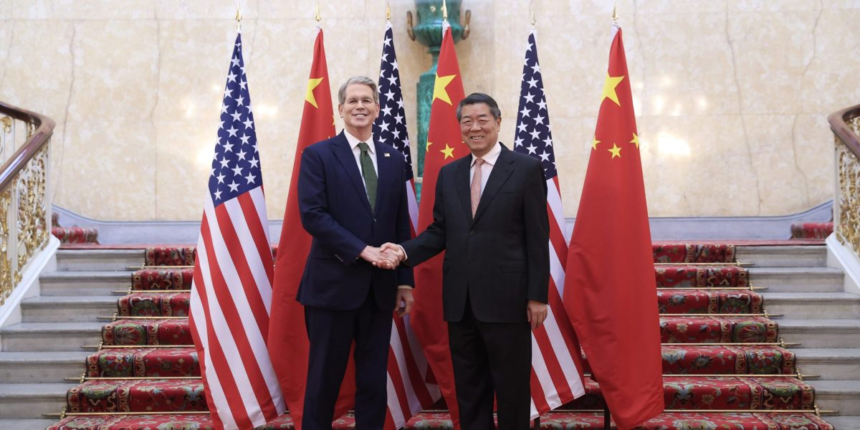

Negotiations between Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng are scheduled to start on Monday in Stockholm.

Bessent highlighted the $550 billion pledge as a key reason the U.S. and Japan were able to settle on a levy that was lower than the 25% rate Trump had threatened earlier.

Similarly, Trump had hinted that the EU would have to “buy down” the threatened tariff rate of 30% and pointed to the Japan deal.

But talks with Beijing may be tougher.

“When Japan broke down and made a deal the EU had little choice,” Jamie Cox, managing partner for Harris Financial Group, said in a note on Sunday. “The biggest piece in the trade deal puzzle still remains, and the Chinese are unlikely to be as willing to fold.”

Without a lasting agreement between the U.S. and China, tariffs could soar back to prohibitively high levels that would effectively cut off trade. In April, Trump had set tariffs on China at 145%, prompting Beijing to retaliate with its own levy of 125%.

Meanwhile, the U.S. has reached deals elsewhere in Asia, with the Philippines and Indonesia facing 19% tariffs while Vietnam has a 20% duty. That’s as Trump seeks to discourage the trans-shipment of Chinese goods via other countries in the region.

Any pledges of investment in the U.S. also come as Trump’s tariffs face legal challenges, with a court hearing scheduled Thursday on whether the president has authority under the International Emergency Economic Powers Act to impose wide-ranging duties.

On Sunday, European Commission President Ursula von der Leyen confirmed that the EU’s $750 billion in U.S. energy purchases would come over the next three years, meaning they will happen while Trump is in office.

But U.S. tariffs could be invalidated before any money is spent, and Wall Street is skeptical that Japan will fully deliver on a target that isn’t a binding commitment.

“Our trading partners and major multinationals know Trump’s tariffs are on shaky legal ground,” they wrote. “Therefore, we find it hard to believe many of them are going to make massive investments in the US they would not have otherwise made in response to tariffs that may not last.”