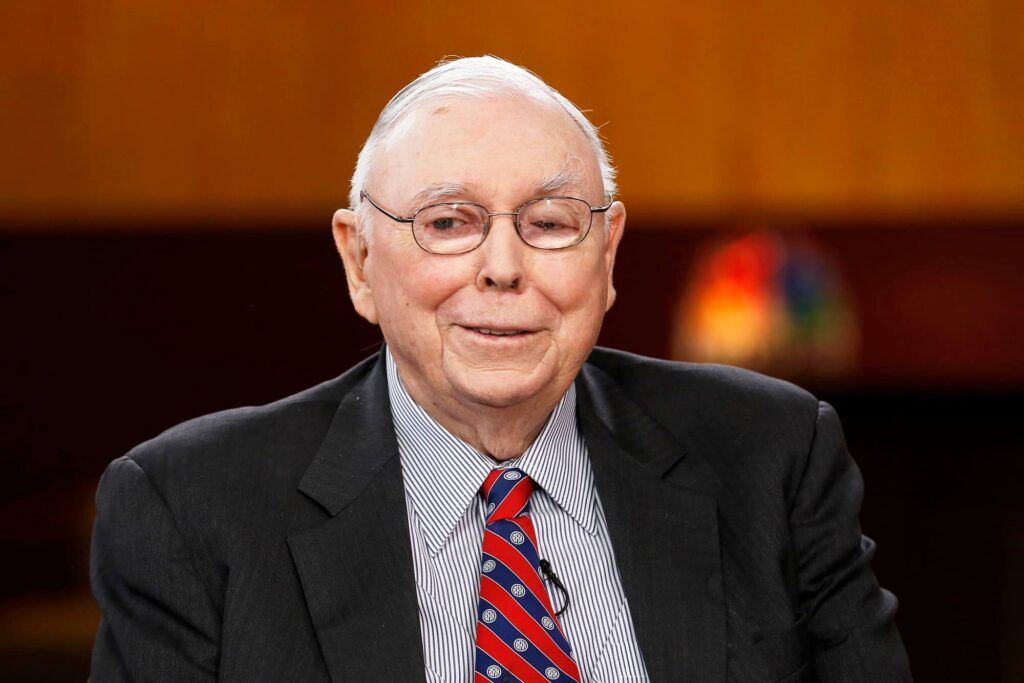

Renowned investor and Berkshire Hathaway Vice Chairman Charles (Charlie) Munger, who passed away in November 2023 at the age of 99, left behind not only a remarkable business legacy but also invaluable investment wisdom. Here are four enduring lessons from Munger’s life that resonate with investors across the spectrum.

1. “The Big Money Is Not In the Buying and Selling, But In the Waiting.”

Munger, in alignment with Warren Buffett, emphasized the rarity and worthiness of true investment opportunities. His belief was rooted in patience, asserting that the key to successful investment lies in finding secure positions and holding onto them. This philosophy is reflected in Munger’s minimal portfolio activity, with reports indicating he maintained shares in only three stocks at the time of his passing: Berkshire Hathaway, Costco, and Daily Journal Corp.

2. “Buy Wonderful Businesses at Fair Prices.”

Central to Munger’s investment strategy was a commitment to value investing. He advocated for buying exceptional businesses at reasonable prices rather than settling for seemingly attractive deals. By focusing on companies with robust fundamentals, Munger aimed for long-term holding, allowing the market to recognize their intrinsic value over time.

3. Great Opportunities Are Rare.

Munger approached investing with the perspective that life does not offer unlimited opportunities. This viewpoint led him to sift through numerous average or subpar ideas, reserving consideration for those surviving stringent scrutiny. Munger’s selective approach involved making significant moves when exceptional opportunities arose, contributing to his notably undiversified portfolio.

4. “Good Businesses Are Ethical Businesses.”

Ethics played a pivotal role in Munger’s investment philosophy. He asserted that good businesses are inherently ethical, while those relying on deceit are destined for failure. Alongside Warren Buffett, Munger conducted thorough assessments of businesses, seeking those with not only strong growth prospects but also ethical and fair operational models. Munger’s preference for businesses that even a fool could run underscored the importance of sustained ethical practices.

Conclusion

Charlie Munger’s investment principles, encompassing patience, value-based decisions, selectivity, and ethical considerations, continue to offer timeless guidance to investors worldwide. As a partner to Warren Buffett, Munger’s legacy extends beyond Berkshire Hathaway, leaving a lasting impact on the broader investment community.