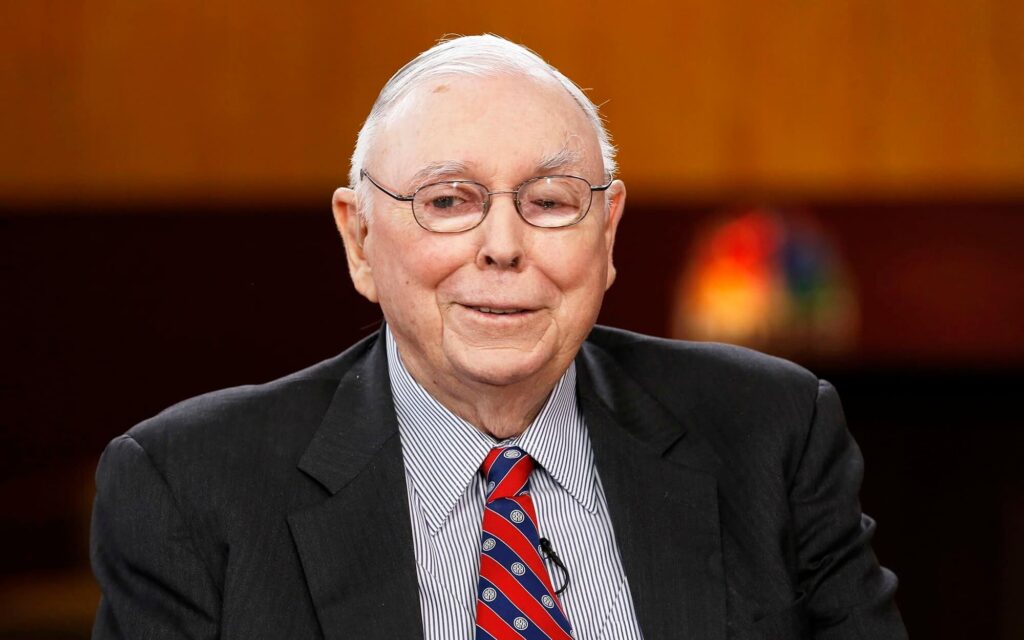

The recent passing of Charlie Munger, a key figure and Vice Chairman at Berkshire Hathaway, has prompted reflections on the company’s future. While Munger played a crucial role as a partner and adviser to CEO Warren Buffett, the impact on Berkshire’s day-to-day operations appears limited, as Buffett has been the driving force behind the company since taking control in 1965.

Buffett, now 93, remains an engaged CEO, emphasizing in a recent interview with Charlie Rose that he is “always on the clock” for Berkshire. Munger, on the other hand, served as more of a sounding board and adviser rather than being deeply involved in the company’s daily affairs.

The market response to Munger’s death was minimal, with Berkshire’s Class B stock experiencing a slight 0.4% dip on Tuesday, closing at $360.05. The current leadership team includes Greg Abel, a likely successor to Buffett, overseeing noninsurance businesses, and Ajit Jain, responsible for the insurance segment. Both have been in their roles since 2018, with Abel taking on increased responsibilities.

Significant changes at Berkshire are anticipated upon Buffett’s departure. The expected post-Buffett leadership team includes Abel as CEO, Jain managing insurance operations, and investment executives Ted Weschler and Todd Combs overseeing the entire investment portfolio.

Buffett’s substantial 15% stake, valued at around $118 billion, will be placed in a trust managed by his three children after his death. This trust is designed to be liquidated over a decade, offering protection from external pressures in the initial years following Buffett’s passing.

Contrary to expectations of a stock decline, Buffett believes Berkshire’s value may rise upon his death. He anticipates that investors will foresee a potential breakup of the conglomerate, speculating that the sum of its parts could be worth more than the whole.

Berkshire Hathaway, a vast conglomerate with holdings ranging from Burlington Northern Santa Fe railroad to Geico, is on track to earn over $35 billion from operations after taxes this year, with a market valuation of $785 billion.

Board member Chris Davis emphasized the board’s role in safeguarding Berkshire from activists and maintaining its unique structure. Davis stated, “Berkshire is worth defending,” highlighting the enduring value of the company’s long-lived assets.

Buffett, in a recent letter to shareholders, expressed confidence in the chosen leadership and the enduring strength of Berkshire’s distinctive characteristics. He noted that decay is not inevitable and that Berkshire’s advantage lies in being built to last.

As the company navigates the post-Buffett era, the board’s focus remains on preserving the unique culture and success that Berkshire Hathaway has achieved under the leadership of Buffett and Munger.