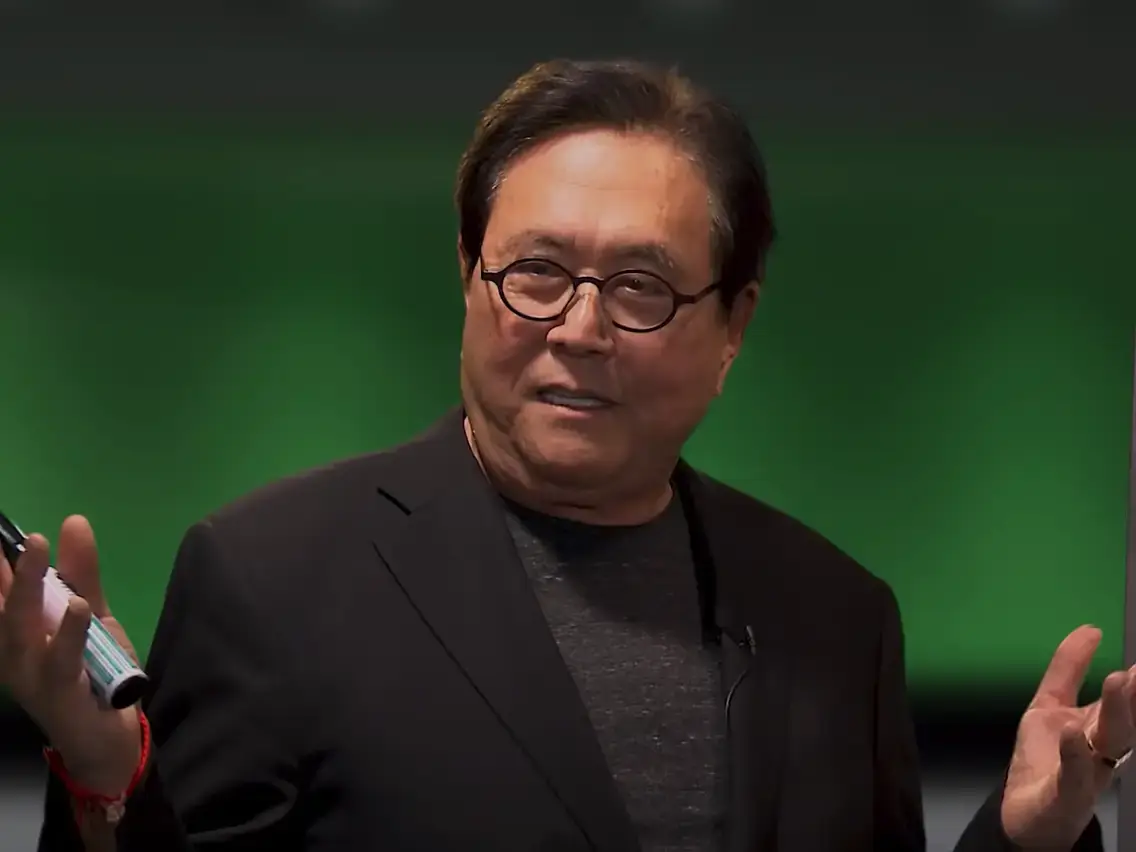

In a recent interview on the Finance with Sharan podcast, renowned American entrepreneur and author of “Rich Dad Poor Dad,” Robert Kiyosaki, voiced strong concerns about the economic trajectory of the United States under the Biden Administration. Kiyosaki, currently in India for Growth Summit India 2023, shared a striking observation from his visit to Mumbai, stating that the slums seen in India are now prevalent across America.

Bearish Views on the Dollar

Known for his unconventional views, Kiyosaki has frequently likened the U.S. dollar to toilet paper and referred to fiat currency as fake. He emphasized his belief that anyone working for dollars, yen, pesos, or rupees is dealing with “fake” money. Kiyosaki categorizes gold as “God’s money,” Bitcoin as “people’s money,” and fiat dollars as “fake money,” highlighting the inherent flaws in the fiat currency system.

Kiyosaki’s Top 3 Investments for Wealth Protection

During the podcast, Kiyosaki discussed his three favorite investments for safeguarding wealth, cautioning crypto enthusiasts about the potential regulatory risks associated with cryptocurrencies. While holding approximately 60 Bitcoins, Kiyosaki advocated for tangible assets such as gold and silver as a hedge against inflation.

- Gold and Silver Bullion: Kiyosaki expressed a preference for physical gold and silver bullion due to their scarcity, making them valuable assets in times of inflation. He mentioned Osisko Gold Royalties Ltd (NYSE: OR) as an option for investors, highlighting its dividend yield of 1.33%.

- Real Estate: As a proponent of real estate, Kiyosaki owns 15,000 houses. He suggested that retail investors can access the real estate market through publicly traded Real Estate Investment Trusts (REITs) like Realty Income Corp (NYSE: O), which offers a 5.7% annual dividend yield.

- Oil: Kiyosaki considers oil the “lifeblood of civilizations” and favors tangible investments like oil wells. While acknowledging the challenges of direct well ownership, he pointed to investing in companies like Chevron Corporation (NYSE: CVX), which owns nearly 35,000 wells in the U.S. and pays a 4.18% dividend yield.

Words of Caution and Wise Investing

Kiyosaki’s statements serve as a warning about the economic challenges facing America, but investors should approach these insights with careful consideration. While fractional ownership and publicly traded options provide accessible routes to these investments, it’s crucial to conduct thorough research and seek advice from investment professionals before making any financial decisions.