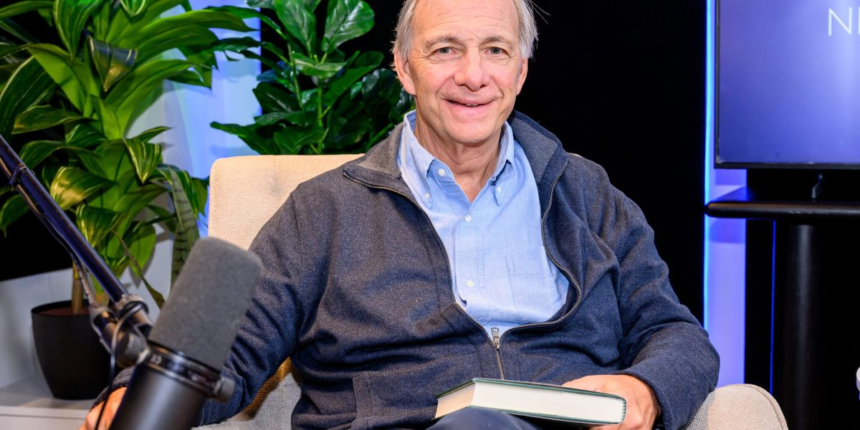

Dalio noted he owns both gold and crypto, but with a caveat, he owns some Bitcoin but not much.

“I’m strongly preferring gold to Bitcoin, but that’s up to you,” he said.

The larger issue is the devaluation of money, and gold has provided a hedge against this issue throughout history. Bitcoin, in recent years, has also played a similar role as a store of value, and “it’s being perceived by many as an alternative money,” he added.

Still, Dalio said he also doesn’t want investors to overload on gold, instead saying, “I want them to diversify well.”

Dalio declined to Fortune comment through a spokesperson.

Both Bitcoin and gold have been on a tear in 2025, with both assets up about 25% year-to-date. Due to further adoption by companies and nations, John Haar, the managing director of Bitcoin-focused financial services company Swan Bitcoin, sees the price of the cryptocurrency rising above $200,000 per coin by the end of 2025.

“The Magnificent 7 have become rather expensive relative to what even optimists would say are the present value of the future cash flows,” he said.

Dalio has warned previously about buying into overvalued stocks even when a company looks great.

“If there’s a lack of faith in the government’s ability to manage the deficit and repay debt, you’re likely to see interest rates rise to compensate for that higher risk. That pushes down the value of existing bonds, which makes them less of a safe haven than they’ve been in the past,” Shipe said.