Donald Trump is taking his battle with Jerome Powell to the doorstep of the Federal Reserve. Literally.

The president will be visiting the central bank at 4 p.m. ET on Thursday, returning to the White House a little over an hour later, per his public schedule.

The move is unusual for a number of reasons. Primarily, because this is the first visit by a president to the central bank in nearly two decades—and only the fourth visit from the Oval Office in history.

In the past, visits from the president to the Fed have been viewed as endorsements—both of the chairman at the time and of the Fed’s independence as a whole.

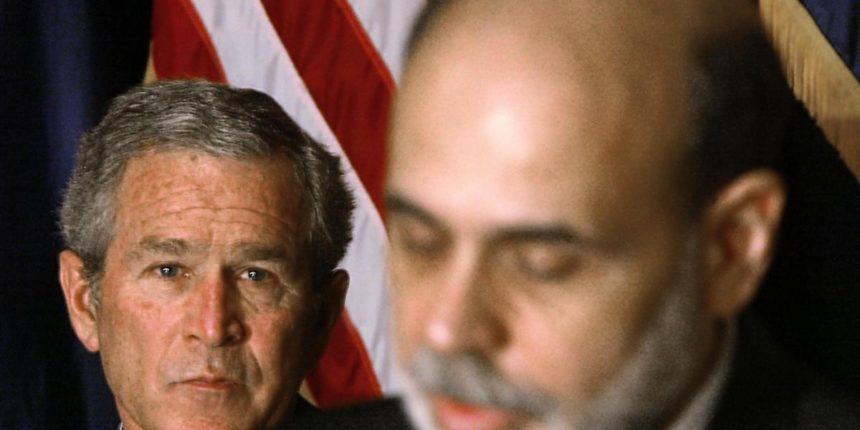

For example, the last visit came from George W. Bush on Feb. 6, 2006, when he attended the swearing-in ceremony for his nominee, Ben S. Bernanke, as the fourteenth chairman of the Fed.

“Across the world, the Fed is the symbol of the integrity and the reliability of our financial system, and the decisions of the Fed affects the lives and livelihoods of all Americans.”

Prior to Bush’s visit, the most recent example of a president visiting the Fed had been President Ford in July of 1975—again for a swearing-in ceremony in which the independence of the central bank was lauded.

The final example—but the first visit of its kind—came in 1937 when President Roosevelt attended the opening of the board’s first building—the Eccles office which President Trump will likely be visiting today.

Back then, the “right thing” in Trump’s mind was not to cut interest rates as it would give the economy, and the Biden administration at the time, a boost.

While some marketeers may agree with Trump’s take that Powell and the Federal Open Market Committee are reacting too slowly to economic data, no analyst or investor wants to see the independence of the central bank threatened.

As such markets reacted shakily when Trump threatened to fire Powell, and then stabilized when the president rescind the suggestion. After all, the federally-mandated independence of the Fed was written into law to protect it from the whims of politicians and instead mandate it to ensure the long-term health of the economy.

Though the Fed has independence over its business management and expenditure, Powell reaffirmed the bank’s commitment to “transparency for our decisions and to be accountable to the public”—announcing a new section of the Fed’s website had been created to keep voters up-to-date with the latest developments.