Investors are witnessing a bullish turn in the market for long-dated US government bonds, with the iShares 20+ Year Treasury Bond ETF marking a significant rebound. The surge, fueled by the Federal Reserve’s openness to interest-rate cuts, aims to bring relief to investors after three challenging years. On Friday, the popular tool for betting on long-dated debt, the iShares 20+ Year Treasury Bond ETF, soared to 99.35, registering a remarkable 21% gain from the 16-year low hit on October 23—an ascent that officially qualifies as a bull market. Despite this rebound, the gauge remains more than 40% below its peak in 2020.

While uncertainty surrounding monetary policy prompts many investors to focus on shorter-dated bonds as a safer option, the allure of substantial gains at the longer end is capturing significant attention. On Friday, the fund experienced a notable inflow of $1.3 billion, marking its largest influx in nearly five months.

Nevertheless, some investors remain cautious, expressing concerns about a potential oversupply of long-term debt issuance and the looming threat of inflation resurgence in the coming year. In seeking compensation for added risk, Kellie Wood, Deputy Head of Fixed Income at Schroders Plc in Sydney, revealed that her firm has been concentrating on shorter-dated notes.

Wood characterized the current market dynamics as a manifestation of “FOMO” or a fear of missing out, particularly among retail investors who have patiently awaited positive returns from fixed income after enduring years of negative returns.

Traders who invested in the 10-year US note sold on November 8 would have enjoyed a 5% gain if they had offloaded the security by the end of last week, according to data compiled by Bloomberg. In comparison, the two-year note auctioned in late October experienced a more modest gain of approximately 1.7% during the same period.

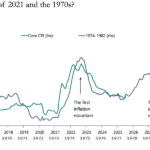

The ETF had entered a bear market in February 2021, with its decline from an August 2020 peak surpassing 20%. Although it had witnessed rises of more than 10% from troughs in December 2021, August 2022, and March 2023, it fell short of the 20% threshold traditionally used to define the conclusion of a bear market and the commencement of a new bull rally.