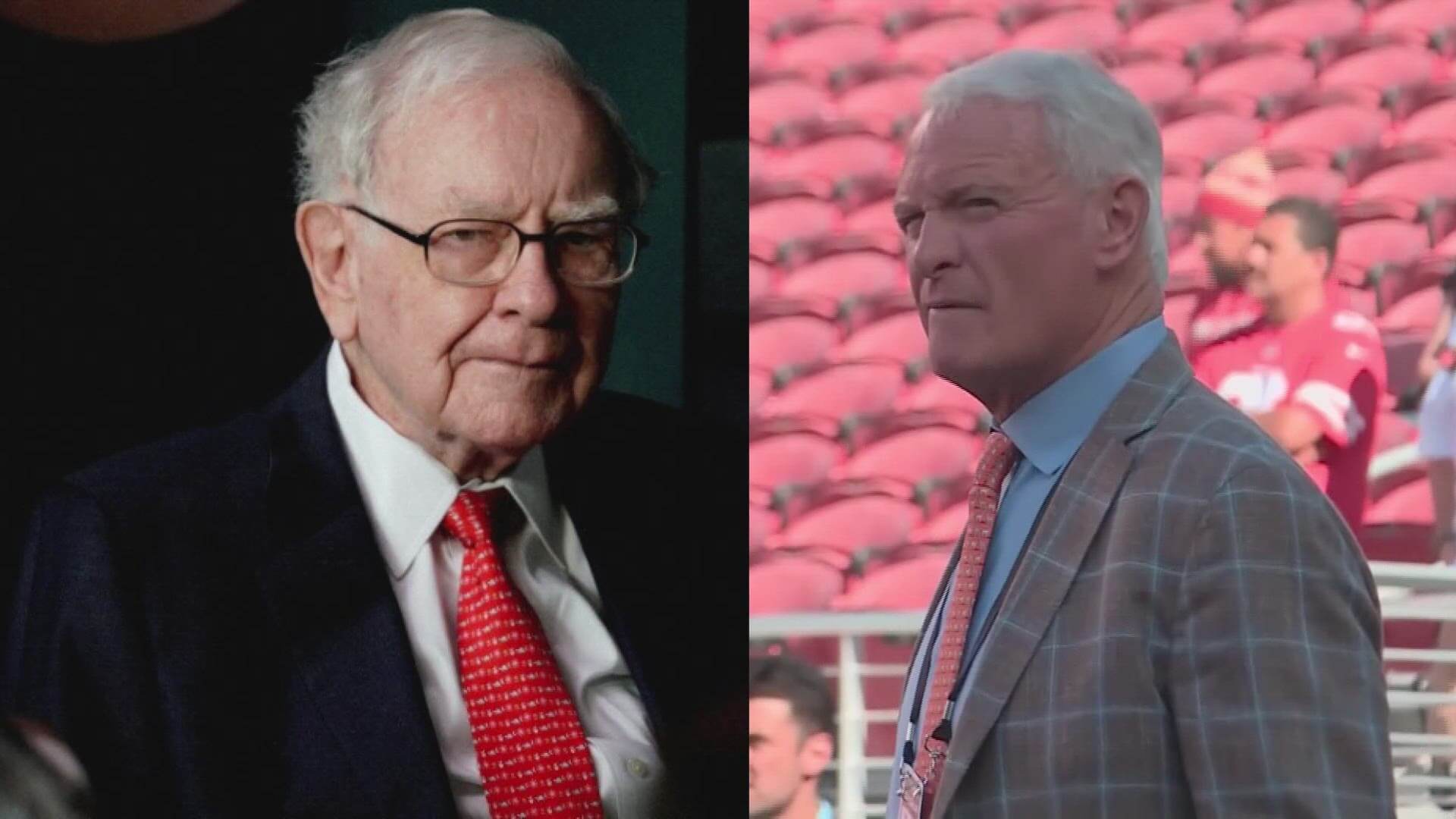

A legal dispute has emerged between Warren Buffett’s Berkshire Hathaway and the billionaire Haslam family, owners of the Pilot truck stop chain. Berkshire accuses the Haslams of attempting to bribe executives to inflate Pilot’s profits, aiming to increase the value of Berkshire’s payment for the Haslams’ remaining 20% stake. The article delves into the unfolding legal saga, revealing allegations from both sides and the potential financial implications.

Berkshire’s Counter Lawsuit: Accusations of Bribery Unfold

- Description: Berkshire Hathaway contends that the Haslam family attempted to bribe at least 15 Pilot truck stop executives with millions to inflate company profits. The motive behind this alleged bribery scheme was to force Berkshire to pay a higher price for the Haslams’ remaining 20% stake in Pilot.

- Legal Battle: The article outlines the counter lawsuit filed by Berkshire and the gravity of the accusations, setting the stage for a hearing to address the conflicting claims.

Details of Alleged Bribes: Haslam Family’s Counteractions

- Description: Berkshire claims that Jimmy Haslam, offering personal bonuses, tried to bribe executives with amounts surpassing their annual salaries. The article explores the redacted details and the number of employees targeted. Additionally, the Haslams’ counterarguments regarding Berkshire’s attempts to understate Pilot’s earnings through accounting changes are discussed.

- Financial Implications: The article sheds light on the potential financial stakes involved in the legal battle, emphasizing the perceived worth of the Haslams’ 20% stake and the impact of Berkshire’s accounting adjustments.

Formulaic Pricing and Berkshire’s Acquisition History

- Description: The article navigates through the pricing structure determining the eventual payment for the Haslams’ stake, based on Pilot’s reported earnings. It traces Berkshire’s acquisition history, from initially buying 38.6% to increasing its stake to 80% in the current year, revealing Warren Buffett’s reflections on the process.

- Industry Impact: Insights into Pilot’s significant role as the nation’s largest truck stop network and its contributions to Berkshire’s financial performance are highlighted.

Pushdown Accounting and Shifting Dynamics

- Description: The article explores the dispute over Berkshire’s shift to “pushdown accounting” and the resulting impact on Pilot’s reported earnings. It addresses the Haslams’ contention that the accounting change led to lower net income. The voting dynamics on this accounting shift within Pilot board meetings are discussed.

- Future Implications: The article examines the potential consequences of the accounting dispute, including its effect on Pilot’s 2023 earnings and the ongoing legal proceedings.

As the legal battle unfolds between Berkshire Hathaway and the Haslam family, the article provides a comprehensive overview of the allegations, financial intricacies, and potential industry repercussions. The upcoming hearing and the broader implications of this dispute on corporate governance and valuation remain central to the unfolding narrative.