Between Wall Street, retail investors, Ivy League economists, and Washington policymakers, you’d be hard-pressed to find someone who isn’t nervous about America’s national debt burden. Their concern is for the day when confidence in the bond market wanes, when buyers of America’s borrowing question whether Uncle Sam can really pay his debts.

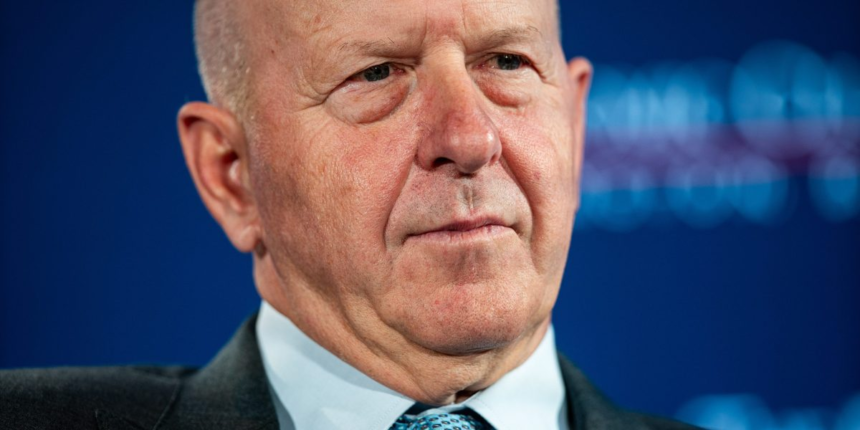

Goldman Sachs CEO David Solomon is among those concerned about the U.S.’s $38 trillion national debt problem, joining the ranks of JPMorgan CEO Jamie Dimon, Fed chairman Jerome Powell, Bridgewater Associates founder Ray Dalio, and increasingly, politicians on Capitol Hill.

The balance of debt to GDP presents two options to reduce the benchmark: either cutting spending or growing the economy. The latter is seen as preferable by many, but potentially an optimistic choice that doesn’t address the problem of fiscal overstretch.

“I think we have some things that are going to give us a better opportunity to have a higher growth trajectory, particularly … technology, AI getting embedded into the enterprise and the productivity opportunity from that,” he continued. “But if we continue on the current course and we don’t take the growth level up, there will be a reckoning.”

Solomon, who has led Goldman Sachs since 2018, added national debt doesn’t have to become a “crisis.” That being said, he did say many of his contacts in the business community are worried about the level of debt and the behavior that now seems to be the norm.

“I think people are worried about … the fact that we’ve reached a point—and by the way, this is true in the United States, but it’s true in every other developed economy—where … fiscal stimulus and aggressive fiscal play is really just kind of embedded in the way these democratic economies are operating, and it’s accelerated meaningfully in the last five years,” he added.

Since President Donald Trump returned to the Oval Office, economists have highlighted the unusual ways the administration is rebalancing the books. While chief among them is raising revenues through tariffs, Trump has also suggested raising funds to pay off national debt through a “gold card” visa scheme which would charge wealth immigrants $5 million for green card privileges “plus a route to citizenship.”

The president said in February he believed he could avert the potential debt crisis entirely with gold cards, saying: “A million cards would be worth $5 trillion, and if you sell 10 million of the cards that’s a total of $50 trillion. Well, we have $35 trillion in debt, so that would be nice.”

He noted he would have $15 trillion “left over” if he managed to sell 10 million cards, adding: “It may be earmarked for deficit reduction, but it actually could be more money than that.”