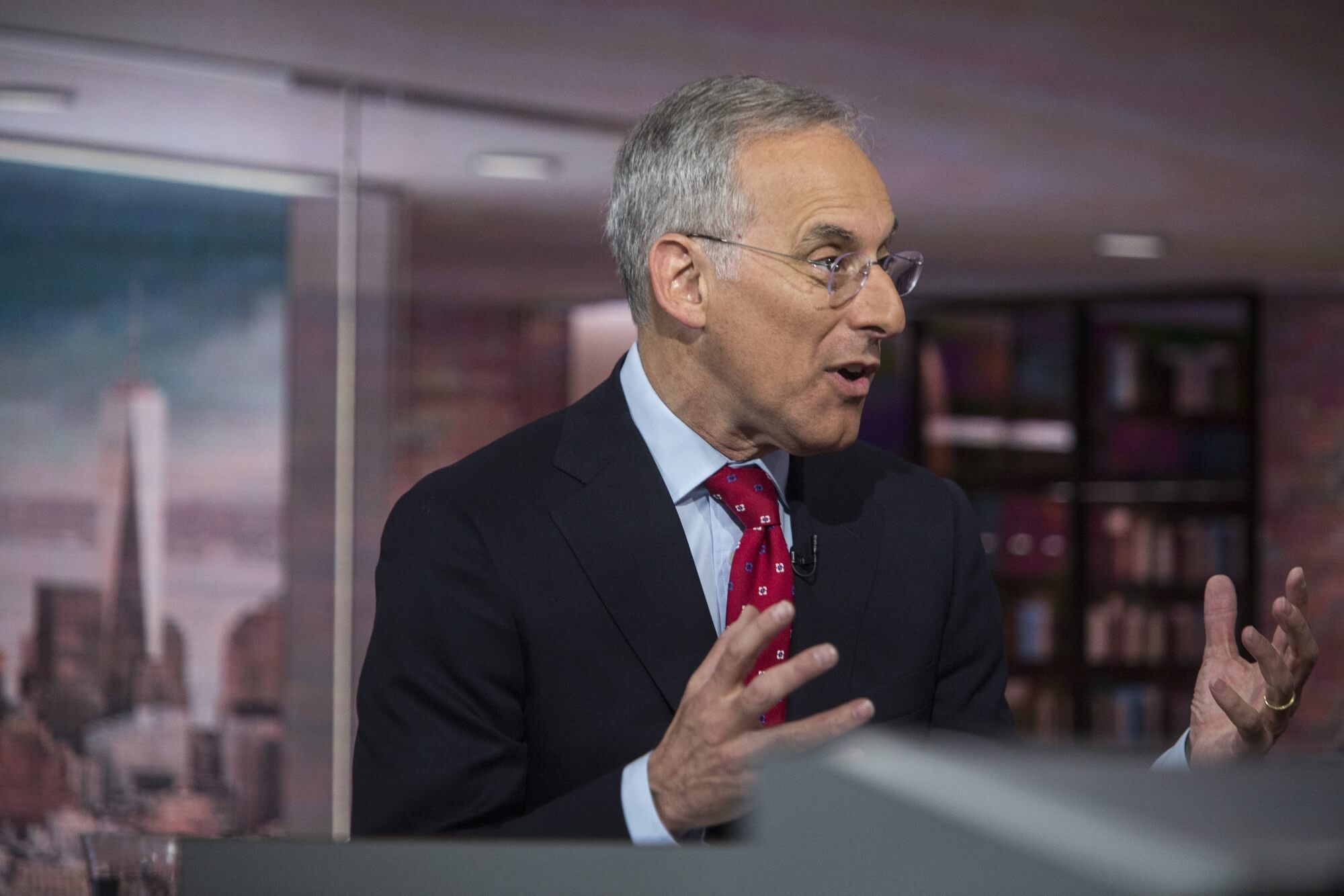

Strategists at Goldman Sachs Group Inc. have expressed optimism that US corporate earnings in 2024 could surpass current forecasts, driven by a robust economy and declining interest rates. The team, led by Chief US Equity Strategist David Kostin, projected a 5% increase in S&P 500 companies’ earnings per share (EPS) to $237 this year, exceeding the median forecast of $231 per share tracked by Bloomberg.

Despite already surpassing consensus estimates, the Goldman Sachs strategists believe there is potential for further upside to their EPS estimate. They attribute this potential improvement to stronger US economic growth, lower interest rates, and a weaker dollar, even in the face of lower oil prices.

As the fourth-quarter earnings for 2023 are set to roll out in the coming week, the strategists anticipate that S&P 500 firms, in aggregate, will outperform analyst forecasts. This positive outlook comes despite a higher bar set for earnings, reflecting the ongoing strength in US data.

Recent concerns about the US central bank’s interest rate hikes, aimed at curbing high inflation, have not derailed the strong economic indicators. With price pressures easing, US Treasury Secretary Janet Yellen declared a rare “soft landing” for the US economy. Futures and swaps traders are now anticipating potential rate cuts by the Federal Reserve, with a likely quarter-point reduction in March.

David Kostin had upgraded his view on the S&P 500 in December, revising his 2024 year-end forecast to 5,100 points from the previous 4,700. He suggested that the earlier earnings prediction might have been too conservative given looser financial conditions. Kostin had previously underestimated the market rally in 2023, initially predicting only a slight gain to 4,000 for the S&P 500 by year-end 2023. The benchmark, however, experienced a 24% rally, closing at 4,769.83 points at the end of the year.

The S&P 500 saw a decline in the first week of 2024, breaking a streak of gains that had lasted for ten weeks, marking the longest streak in almost two decades.