This morning, investors appear to be taking the news to heart. The STOXX Europe 600 fell 1.41% in early trading. The U.K.’s FTSE 100 was down 1.11% before lunch, and Japan’s Nikkei 225 gave up 1.74%. South Korea got hit the worst: The KOSPI was down 2.37%.

Prior to the opening of the market in New York, S&P 500 futures are down more than a full percentage point.

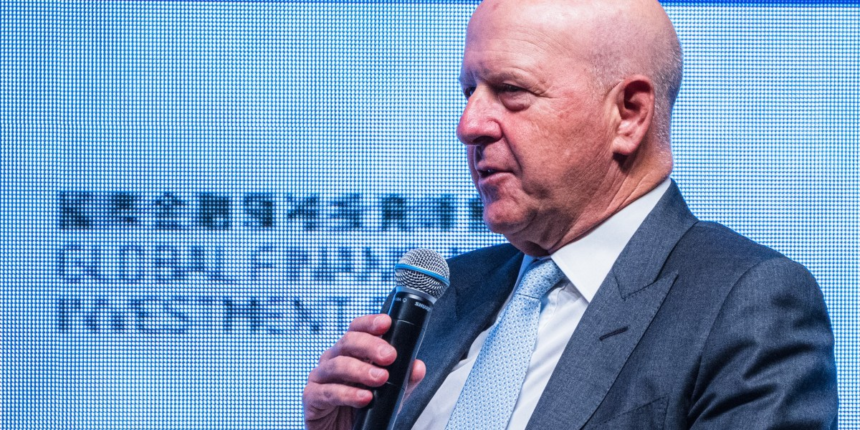

On the same panel, Morgan Stanley CEO Ted Pick agreed: “We should also welcome the possibility that there would be drawdowns, 10 to 15% drawdowns that are not driven by some sort of macro cliff effect,” he said.

Morgan Stanley’s chief investment officer, Lisa Shalett, issued a note to clients yesterday arguing that now may be the time to sell speculative tech stocks. “With more questions than answers, we maintain maximum diversification. Consider taking profits in high-beta, small/micro-cap, speculative and unprofitable equities and redeploying to large-cap core and quality stocks, including the ‘Mag 7’ and GenAI beneficiaries in financials, health care and energy,” she wrote.

The ongoing U.S. government shutdown added to the economic gloom. Investors are flying blind—U.S. trade data should have been published today but won’t be. Instead, investors are looking at less reliable private data. The ISM manufacturing index for October signalled a contraction at 48.7%, well under the consensus expectation of 49.3%.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning: