Well, maybe.

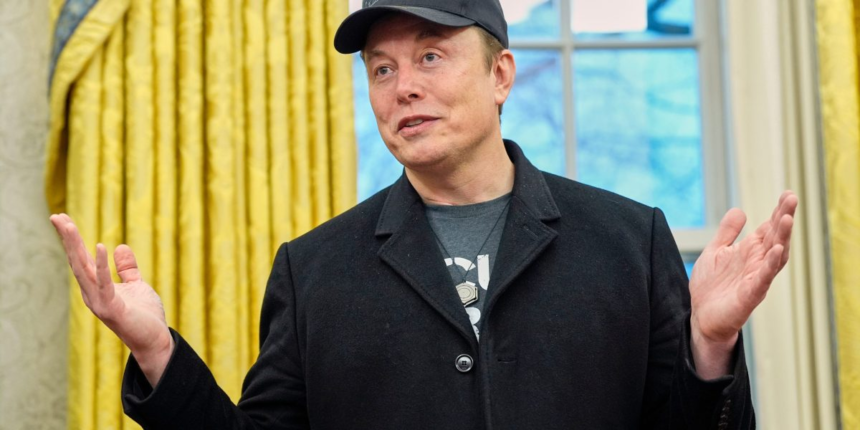

The electric vehicle maker run by Musk reported Thursday that car sales jumped 7% in the three months through September after plunging for most of the year as people turned off by his embrace of President Donald Trump and far-right politicians in Europe balked at buying his cars.

But the jump comes with a caveat: Tesla benefited from consumers taking advantage of a $7,500 tax credit before it expired on Sept. 30, a surge in buying that helped all EV makers.

In fact, many Tesla rivals saw sales rise more. Rivian Automotive reported a 32% increase.

Tesla stock rose sharply on the sales news, but closed the day down 4.5% to $439 amid skepticism the new number really signals a turnaround given all the anti-Musk backlash.

“I don’t think most people are any more enamored with Elon now than they were a few months ago,” said Telemetry Insight’s Sam Abuelsamid. “I expect this is more a blip for Tesla than the restart of growth.”

Even Tesla bull Dan Ives of Wedbush Securities was cautious, noting there are “still demand issues.”

Still, it was a blowout number with sales hitting 497,099 vehicles versus 462,890 in the same period last year. Analysts expected a small drop to 456,000.

Investors cheered Musk’s decision in April to leave Washington for Austin, Texas, where Tesla is headquartered. But he is still heavily involved in political and social wars, alienating potential car buyers.

The sharp fall in Tesla stock Thursday was remarkable as investors have been surprisingly optimistic about the company in recent weeks despite terrible financial figures.

Investors drove the stock up 34% in September alone in a bet that Musk’s planned new cheaper version of his bestselling Model Y will recharge sales. Musk has also been successful in shifting investor attention away from cars to other aspects of the business — the rollout of its driverless robotaxi service planned for several cities and its Optimus robots for factory work and household chores.

Driving the stock higher has also been Musk’s apparent renewed focus on the company.

If Musk meets the goals, he could set a record on top of his own record. He recently became the first person ever to hit $500 billion in net worth, at least according to rich list compiler Forbes magazine.

For her part, the Tesla head of the board of directors who approved Musk’s latest pay package recently told Bloomberg that she is not sure if Musk’s politics have had any impact on the company’s finances. Robyn Denholm has earned nearly $700 million in compensation for serving on the board since 2014, a package that itself has drawn criticism.