Stop worrying about the bubble in AI—its growth is sustainable, three Wall Street analysts from Goldman Sachs, JPMorgan, and Wedbush argued this morning in notes seen by Fortune.

We should all stop worrying and learn to love the AI boom, if new research from Goldman Sachs is correct. In a note titled “The AI Spending Boom Is Not Too Big,” Joseph Briggs and his colleagues say, “Anticipated investment levels are sustainable, although the ultimate AI winners remain less clear.”

The Goldman team argues that when deployed properly, the productivity gains from AI will far exceed the investment currently going into it.

“We are not concerned about the total amount of AI investment. AI investment as a share of U.S. GDP is smaller today (<1%) than in prior large technology cycles (2%-5%). Furthermore, we estimate an $8 trillion present-discounted value for the capital revenue unlocked by AI productivity gains in the U.S., with plausible estimates ranging from $5 trillion–$19 trillion,” they said.

The money going into AI-related capital expenditures (capex) will grow massively this year and next, according to Samik Chatterjee and his colleagues at JPMorgan. Capex across the AI “hyperscalers” will grow 60% this year and another 30% next year, they say.

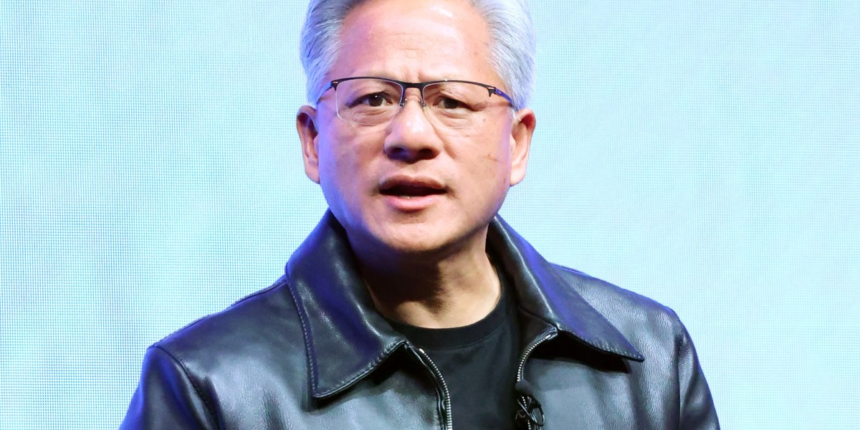

The irrepressible Daniel Ives of Wedbush, perhaps Wall Street’s biggest cheerleader for AI, took a field trip to Asia to see for himself what the demand for Nvidia’s chips is like. “We estimate the demand to supply ratio from enterprises for Nvidia’s next generation GPUs are approaching 10:1, which is a staggering number, which speaks to how early this AI revolution is in its life cycle,” he told clients in a research note. “We have barely scratched the surface of this fourth industrial revolution.”

Here’s a snapshot of the markets ahead of the opening bell in New York this morning: