The U.S. dollar’s downtrend continued as traders bet on the Federal Reserve nearing the end of its rate-hiking cycle, resulting in its worst month since November of the previous year. Despite this, Treasury yields stabilized following a recent rally.

The greenback marked a fourth consecutive day of decline, heading for its most significant monthly drop in a year. Optimism regarding potential Fed rate cuts contributed to this trend. The South Korean won and Thai baht led gains in Asia, with the won experiencing its most significant jump in almost two weeks.

Treasuries remained relatively unchanged after a prior rally, during which the two-year note’s yield, sensitive to the Fed’s rate trajectory, reached its lowest in a week. On Monday, benchmark 10-year yields dropped by eight basis points to approximately 4.4%.

Improved investor sentiment and reduced recession expectations have led Wall Street forecasters to adopt a more positive outlook for the coming year. The recent S&P 500 rally, attributed to expectations of the Fed concluding rate hikes, further supports this trend.

According to Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, the July rate hike was likely the Fed’s last. However, she cautioned that anticipating rate cuts by the end of the first quarter or first half of the following year could signal a weaker economic and labor market backdrop.

The Bloomberg U.S. Treasury Index has shifted to a positive return for the year, fueled by slowing inflation signs and measured jobs growth. Swaps data indicates that investors are pricing in around 95 basis points of Fed rate cuts from January into the end of the next year.

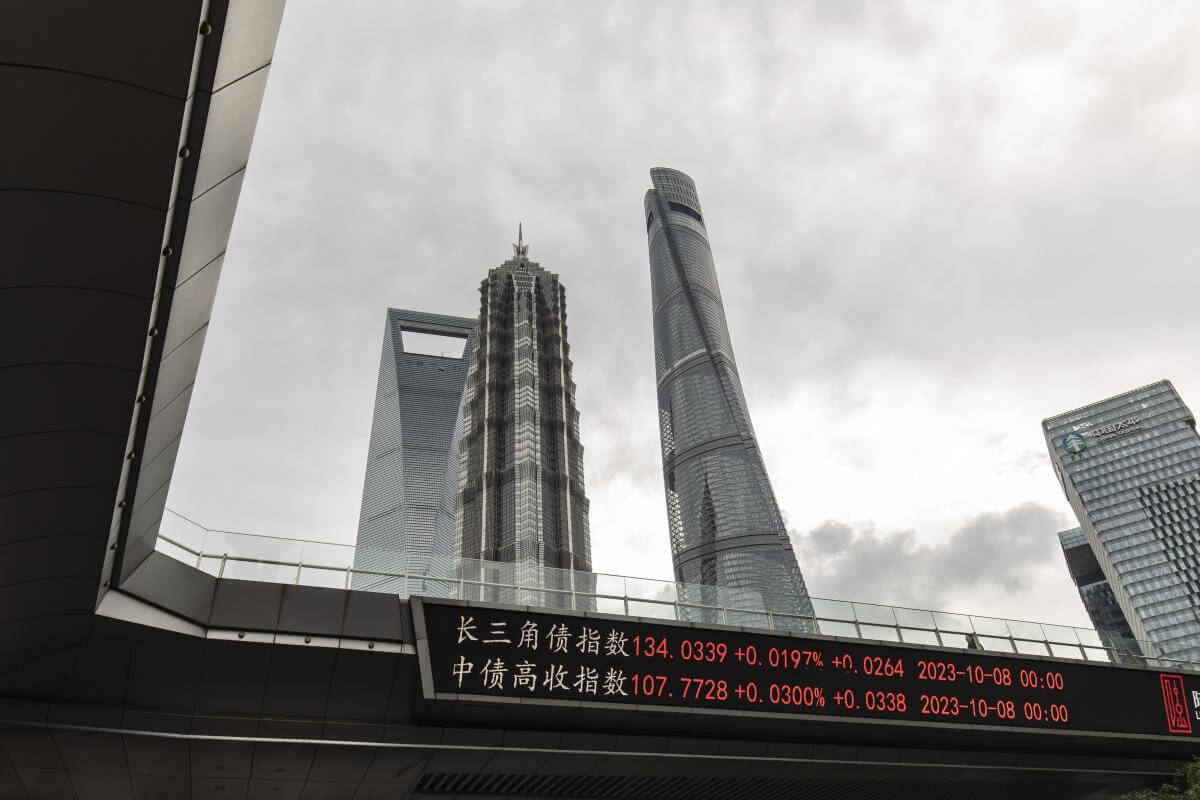

Stocks in Asia experienced mixed performance, with Japanese equities declining as the yen strengthened. Hong Kong shares fell, while South Korean stocks gained. U.S. equity futures showed minimal change. Traders kept a close eye on the fallout from a criminal probe into China’s Zhongzhi Enterprise Group, estimating potential investor losses at $56 billion.

Australia and New Zealand bonds mirrored Monday’s Treasury rally. Japan’s 40-year government bond auction recorded a bid-to-cover ratio drop to a 20-month low, reflecting weak demand.

The MLIV Pulse survey indicated that over 60% of respondents anticipate stocks to outperform bonds in the next month, the highest level of excitement about equities since the survey began in August 2022.

Economic data to be closely watched this week includes the Fed’s preferred measure of underlying inflation and U.S. new house sales data for October. Traders are also awaiting comments from Fed Chair Jerome Powell, while earnings reports from Crowdstrike Holdings Inc., Salesforce Inc., and Dell Technologies Inc. are anticipated.

Government debt sales in the U.S. on Monday had mixed reactions, with strong demand for a $55 billion auction of five-year bonds and softer demand for a $54 billion sale of two-year notes.

In other markets, gold stabilized near its highest level since May, supported by falling Treasury yields and expectations of Fed interest rate cuts. Oil prices remained steady amid speculation about deeper output cuts from OPEC+ against signs of oversupply.

Key Events This Week:

- NATO foreign ministers meeting in Brussels (Tuesday-Wednesday)

- Speeches by ECB governing council member Pablo Hernandez de Cos and Bank of England Deputy Governor Dave Ramsden (Tuesday)

- US Conference Board consumer confidence data (Tuesday)

- Speeches by Fed Governor Chris Waller and Chicago Fed President Austan Goolsbee (Tuesday)

- New Zealand rate decision (Wednesday)

- OECD releases biannual economic outlook (Wednesday)

- Eurozone economic confidence and consumer confidence data (Wednesday)

- Speech by Bank of England Governor Andrew Bailey (Wednesday)

- US wholesale inventories and GDP data (Wednesday)

- Speech by Cleveland Fed President Loretta Mester (Wednesday)

- Fed releases its Beige Book (Wednesday)

- China non-manufacturing PMI and manufacturing PMI data (Thursday)

- OPEC+ meeting (Thursday)

- Eurozone CPI and unemployment data (Thursday)

- US personal income, PCE deflator, initial jobless claims, and pending home sales data (Thursday)

- China Caixin Manufacturing PMI data (Friday)

- Eurozone S&P Global Manufacturing PMI data (Friday)

- US construction spending, ISM Manufacturing data (Friday)

- Fireside chat with Fed Chair Jerome Powell in Atlanta and speech by Chicago Fed President Austan Goolsbee (Friday)