As 2023 progresses, China continues to grapple with deflationary pressures, underscoring the fragility of its ongoing economic recovery. Economists surveyed by Bloomberg anticipate that data to be released this Thursday will reveal that Chinese consumer prices returned to deflationary territory in October, with producer prices also likely to have fallen for the 13th consecutive month.

China’s consumer costs have remained persistently weak throughout the year. In July, the consumer price index entered a period of deflation, and since then, it has oscillated between negative and positive year-on-year growth. Despite the People’s Bank of China’s prediction in August that prices would rebound after a rough summer patch, another drop may indicate that their assessment was overly optimistic.

Morgan Stanley has warned that China may face a prolonged battle against declining prices in the coming years, noting that Beijing is “at the initial stage of the deflation battle” as it transitions away from an “overextended, credit-fueled growth model.”

The possibility of weak inflation figures adds to the uncertainty surrounding China’s economic outlook, following an unexpected contraction in factory activity and slowing growth in the services sector in October.

According to Larry Hu, Head of China Economics at Macquarie Group Ltd., “China’s consumption demand is still weak.” Hu expects the GDP deflator, the broadest measure of prices, to likely be negative in the final three months of the year. This comes after two consecutive quarters of decline, as estimated based on official data.

Upcoming reports in the following days are expected to provide additional insights into the trajectory of China’s economic recovery. Export figures due on Tuesday are likely to show a narrowing drop in October compared to the previous year, partly due to a lower base of comparison with October 2022 when China was still dealing with pandemic-related lockdowns.

Additionally, credit data for the last month may be released, likely showing an increase in overall financing compared to the previous year as an influx of government bonds enters the market.

There are increasing expectations for the central bank to inject more liquidity into the market by reducing the reserve requirement ratio – the amount of cash that banks are required to keep in reserve. Some analysts predict that the central bank may take this step ahead of its monthly policy loan operations in mid-November, as a surge in government bond issuance puts pressure on interbank liquidity.

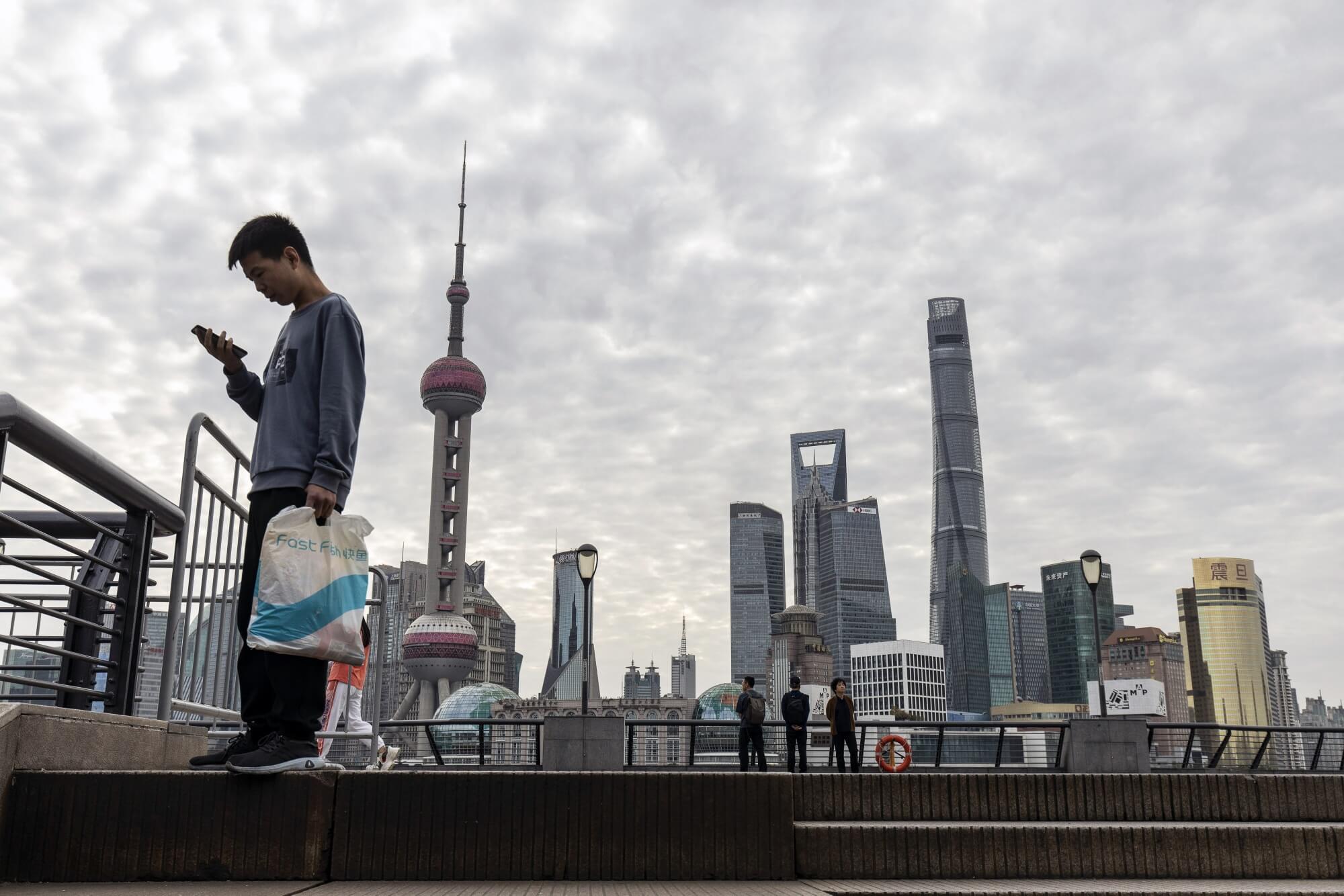

In a recent speech at the China International Import Expo in Shanghai, China’s Premier Li Qiang pledged to expand market access and boost imports to counter this year’s decline.

In other parts of Asia, the Reserve Bank of Australia is expected to raise its borrowing costs to a 12-year high of 4.35%, while Bank of Japan Governor Kazuo Ueda may provide further clarification on the recent decision to allow more flexibility in bond yield movements.

Elsewhere in the region, GDP figures for the third quarter are expected to show a slowdown in Indonesia’s economy and a rebound in output in the Philippines, while inflation numbers from Thailand, the Philippines, and Taiwan are projected to indicate slowing price growth.

Europe, Middle East, and Africa

The German economy is anticipated to show further economic challenges, with factory output data and industrial production figures expected to reveal contractions in September.

In response to Germany’s recent economic struggles, Bundesbank President Joachim Nagel has been actively defending the economy. A dozen Governing Council members, including ECB President Christine Lagarde and Chief Economist Philip Lane, are scheduled to speak, with market attention focused on their views regarding the European Central Bank’s next steps.

The ECB will also release its monthly survey of consumers’ inflation expectations. European Union finance ministers are set to meet later in the week to discuss the EU’s deficit rules, which are scheduled to come back into effect in 2024, though they are under review.

Poland, Romania, and Serbia are holding rate decisions. Poland is expected to reduce its key rate by a quarter point, while Romania and Serbia are likely to keep rates steady.

In the UK, data on Friday is projected to reveal a contraction in gross domestic product in the third quarter, which Bloomberg Economics suggests could mark the start of a recession. Bank of England Governor Andrew Bailey and Chief Economist Huw Pill are scheduled to speak.

In Egypt, there is anticipation regarding whether inflation slowed in October or accelerated to another record high. The central bank is under pressure to devalue the pound, which may temporarily push the inflation rate higher, but such a decision is unlikely to be made before presidential elections in December.

Data from Saudi Arabia indicates that its non-oil economy experienced the fastest job growth in nine years in October, suggesting an improvement in business conditions as the country seeks to diversify.

Latin America

Four major Latin American economies, including Brazil, Chile, Colombia, and Mexico, are expected to report October inflation data. Brazil is likely to witness a decrease after a three-month rise from 3.16%, but disinflation is anticipated across all five economies. However, none are forecasted to return to their inflation targets before the end of 2024.

In response to inflationary pressures, Brazil’s central bank is expected to release the minutes of its decision in November to deliver a third consecutive half-point rate cut to 12.25%.

Mexico’s central bank is anticipated to maintain its key rate at 11.25% due to robust economic growth and above-target inflation. It is expected to be the last of the region’s central banks targeting inflation to begin cutting interest rates, with some board members suggesting they may not move until mid-2024.

On the contrary, the Central Reserve Bank of Peru started easing its monetary policy in September, with a third consecutive quarter-point cut to 7% expected following a decline in consumer prices in October.