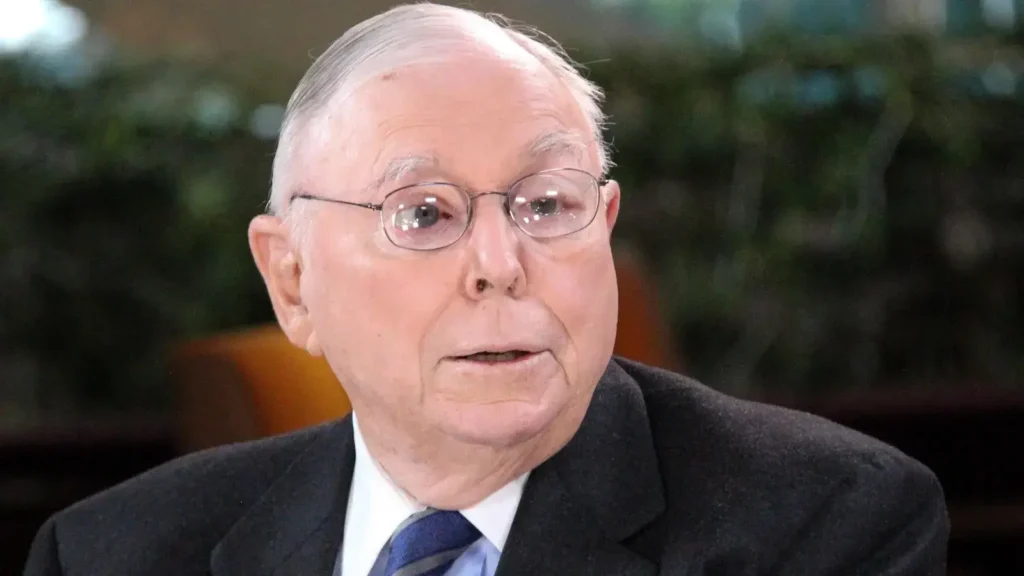

In the early 2000s, Charlie Munger, the Vice Chairman of Berkshire Hathaway Inc., made a daring yet calculated financial move. He entrusted a significant portion of his family’s fortune — $88 million — to Li Lu, often referred to as the Chinese Warren Buffett.

This bold investment, although risky, not only remained secure but also experienced substantial growth, now estimated at approximately $400 million.

Munger remarked, “We made unholy good returns for a long, long time. That $88 million has become four or five times that.”

Their first encounter took place at a mutual friend’s residence in Los Angeles shortly after Li’s college graduation. Despite Munger’s reserved demeanor initially, their discourse was filled with Munger’s insightful words of wisdom.

It wasn’t until seven years later, during a Thanksgiving lunch in 2003, that Munger and Li engaged in a “long heart-to-heart conversation.” Impressed by Li’s investment prowess, Munger backed him with personal funds when Li embarked on a new fund venture in 2004.

Li’s investment track record boasts notable achievements, including Kweichow Moutai, a liquor brand that has surged in value over the past two decades, ranking among China’s largest listed companies. Despite the pandemic, Kweichow Moutai had a fantastic year in 2020, with its stock on the Shanghai Stock Exchange rising by about 70%.

Munger commended Li’s astute decision-making, noting, “It was real cheap, four to five times earnings, and Li Lu just backed up the truck, bought all he could and made a killing.”

Li’s investment strategy focuses on identifying undervalued prospects, emphasizing that unconventional investments often harbor the greatest potential for growth. His ability to recognize undervalued opportunities has unlocked exceptional value over time.

Li’s most renowned investment is in BYD Co. Ltd., a manufacturer of batteries and electric vehicles. Munger described the early investment in BYD as a “miracle” and noted that BYD has outpaced Tesla Inc. in China.

While Munger placed immense trust in Li, considering him the sole outsider he has ever entrusted with his finances, he also predicted that Li would eventually assume a significant role at Berkshire Hathaway.