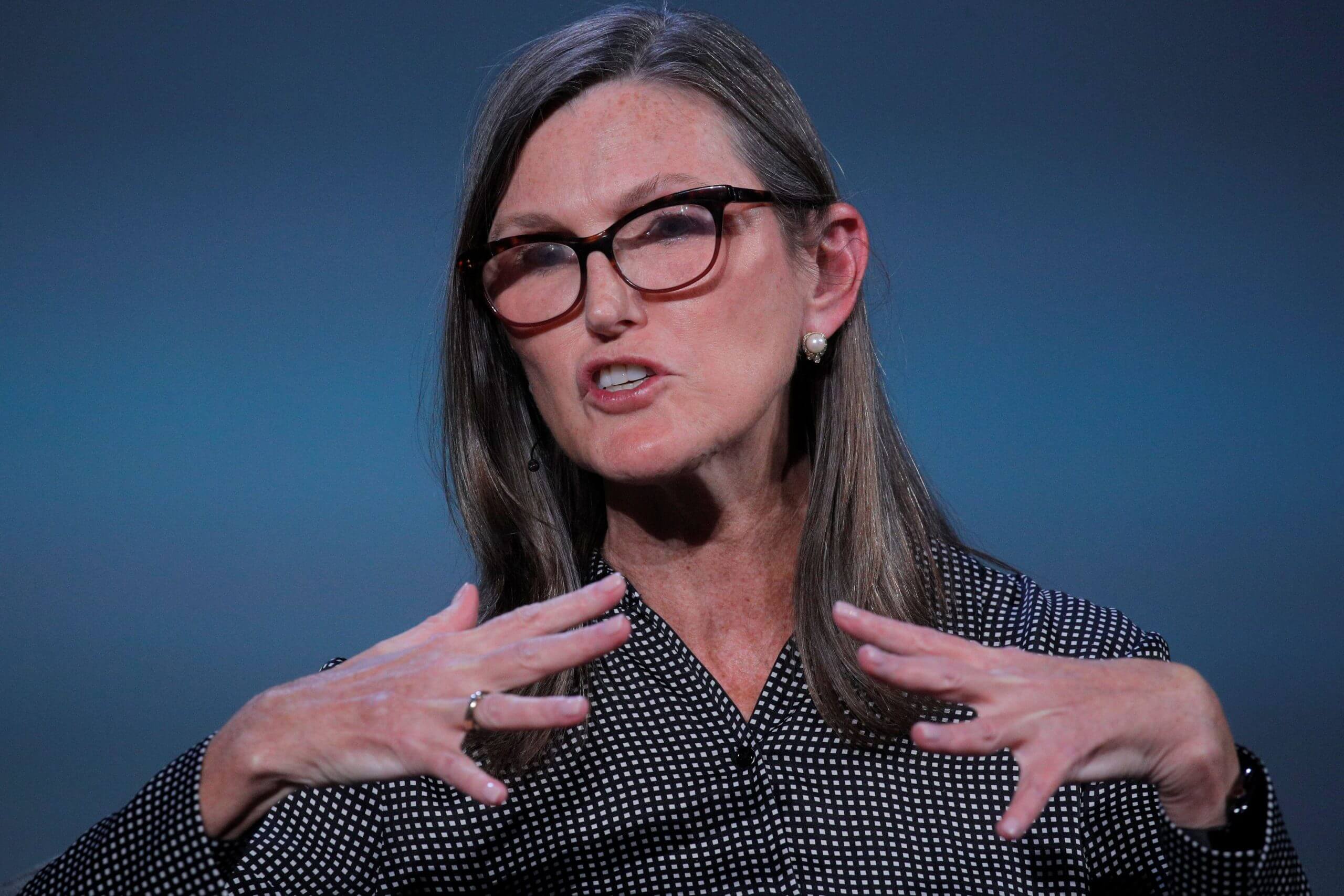

Renowned investor Cathie Wood has initiated the new trading year with strategic acquisitions for her Ark Invest family of exchange-traded funds. In a surprising thematic twist, all three stocks she recently purchased start with the letter “R,” creating a unique and unintentional trend. Let’s delve into the details of her latest moves.

Stock Analysis:

- Roku (NASDAQ: ROKU)

- Despite Roku’s remarkable 2023 performance, which saw its shares more than double, Cathie Wood continued to build on her position in the streaming service giant.

- Roku faced challenges in 2021 and early 2023, with mounting losses and slowing revenue growth. However, a resurgence in popularity and a top-line turnaround have brought the company back into the spotlight.

- The platform has experienced three consecutive quarters of accelerating revenue growth, reaching 20% in the latest report. Active accounts on Roku now stand at 75.8 million, indicating a 16% YoY increase and a 34% surge over the past two years.

- While losses persist, Roku aims to address bottom-line concerns by focusing on content and expanding its product offerings. Analysts foresee a significant reduction in red ink in 2024, provided the company can balance margin expansion with sustained user growth and recovery in the advertising market.

- Recursion Pharmaceuticals (NASDAQ: RXRX)

- Recursion Pharmaceuticals, with a market cap of $2.1 billion and trailing revenue just below $50 million, may not appear cheap by traditional valuation metrics. However, its appeal lies in its long-term potential, especially for investors in early-stage biotechs.

- Functioning as a clinical-stage techbio company, Recursion employs the Recursion OS platform, utilizing machine-learning algorithms and vast biological and chemical relationships to expedite future treatments.

- While profitability and meaningful revenue generation are years away, Recursion’s strong balance sheet and strategic deals to expand its platform and enhance artificial intelligence capabilities position it favorably for future growth.

- Rocket Lab USA (NASDAQ: RKLB)

- Rocket Lab USA, a seasoned space services provider, faced challenges when one of its rockets exploded in September. However, the company rebounded recently with a $515 million contract to build and operate 18 satellites for an undisclosed U.S. government customer.

- Despite setbacks, Rocket Lab closed at $5.31 on Tuesday, showcasing stability after the post-explosion dip. Wood’s decision to increase her stake implies confidence in the company’s ability to rebound.

- With a track record of successful satellite launches, Rocket Lab’s resilience and Wood’s additional investment suggest optimism for the company’s future growth.

Investment Considerations: Cathie Wood’s strategic acquisitions reflect her confidence in the growth potential of Roku, Recursion Pharmaceuticals, and Rocket Lab USA. Investors should monitor these stocks for potential developments in their respective industries and assess their fit within a diversified portfolio.