The Biden administration is set to introduce new regulations aimed at retirement plan providers, designed to eliminate perceived loopholes that enable the industry to promote products that benefit their revenue at the expense of customers. This initiative marks the latest attempt by the administration to address what it refers to as “junk fees.”

The proposed rules from the Labor Department would compel retirement plan providers to sell commodities and insurance products, including annuities, to clients only when it is deemed to be in the customer’s best interest. It would also raise the standards of Wall Street’s advice when individuals transfer assets from an employer’s plan to another account, such as moving from a company-sponsored 401(k) to an Individual Retirement Account (IRA).

Lael Brainard, director of the White House National Economic Council, emphasized that financial advisors should prioritize the best interests of savers and refrain from selling products with lower returns simply to maximize their own fees. Brainard stated, “When a retirement saver pays for trusted advice that is not in their best interest and comes at a hidden cost to their lifetime savings, that’s a junk fee.”

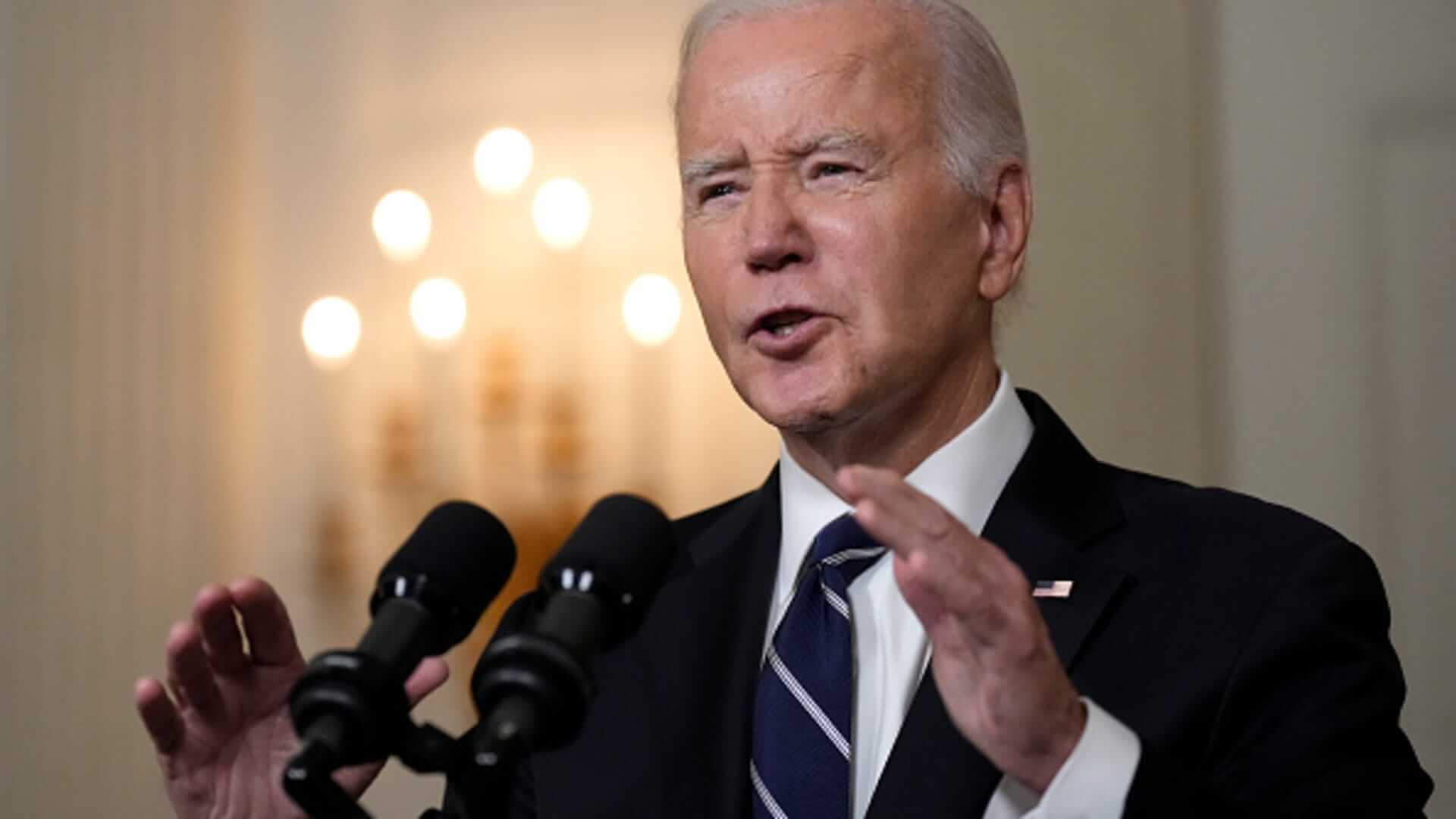

President Joe Biden has aligned with companies like Airbnb and Live Nation to combat “junk fees” – additional charges incurred by customers when booking concert tickets, hotels, and airfares. Addressing these fees is essential for Biden’s administration to demonstrate its commitment to helping people manage costs, especially as many Americans express dissatisfaction with his economic stewardship.

The proposed rule by the Labor Department aims to compel brokerage firms to prioritize investors’ needs over products that offer them higher payouts. The Securities and Exchange Commission’s existing regulations require advice on purchasing securities, such as mutual funds, to align with the saver’s best interests. However, this requirement does not extend to commodities or insurance products like fixed index annuities, which are often recommended to retirement savers.

The new rule would establish a standard where retirement advisers are obliged to provide advice in the best interest of savers, regardless of whether they are recommending securities or insurance products. It also applies to the location where advice is provided.

Federal laws governing retirement plans do not consistently mandate that retirement advisers offering one-time advice, such as when rolling over assets from a 401(k) into an IRA or annuity, must exclusively prioritize the saver’s interest. Notably, in 2022, Americans rolled over approximately $779 billion from defined contribution plans, like 401(k)s, into IRAs. The proposed rule seeks to close this gap, ensuring that all such advice serves the best interest of savers.