Asian stocks saw modest gains on Tuesday, while the dollar lingered near three-month lows. Investors remain convinced that the Federal Reserve has completed its rate-hike cycle, with attention turning to a crucial inflation report later in the week.

MSCI’s broadest index of Asia-Pacific shares outside Japan edged 0.29% higher, heading for nearly a 7% gain in November, marking its most robust monthly performance since January.

European stock markets, however, were poised for a lackluster start. Eurostoxx 50 futures dipped 0.11%, German DAX futures 0.18% lower, and FTSE futures down 0.09%. U.S. stock futures showed little change.

Investors are eagerly awaiting the Fed’s preferred inflation measure on Thursday and euro zone consumer inflation figures for insights into price trends and future monetary policy directions.

Vasu Menon, Managing Director of Investment Strategy at OCBC Bank in Singapore, noted that if the data reveals a further cooling of inflation, markets are likely to be more comfortable with expectations that the Fed will pause. Menon emphasized the importance of the December payroll numbers as well.

Market expectations currently indicate a 95% likelihood that the U.S. central bank will leave interest rates unchanged next month, with the possibility of a rate cut gaining traction by mid-2024, according to CME’s FedWatch tool.

OCBC Bank’s Menon suggested that the Fed might consider rate cuts when inflation dips below the 3% mark, potentially happening in the middle of next year.

Central banks worldwide are cautious about signaling rate cuts, emphasizing the need for higher rates to tackle inflation. Bank of England Deputy Governor Dave Ramsden mentioned the likelihood of restrictive monetary policy for an extended period.

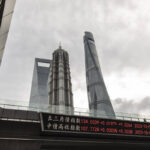

China’s CSI 300 Index declined by 0.17%, while Hong Kong’s Hang Seng index fell 1%. In Japan, the Nikkei eased by 0.12%, yet it is up 8% for the month, on track for its most robust monthly performance in three years.

The dollar index, gauging the greenback against a basket of currencies, touched its lowest since Aug. 31 at 103.07. The Japanese yen strengthened to 148.27 per dollar, and the euro eased to $1.0948.

Crude oil prices experienced fluctuations, with U.S. crude down 0.13% at $74.76 per barrel and Brent slipping below $80 ahead of the OPEC+ meeting later this week.

Gold prices rose 0.1% to $2,015.00 an ounce after hitting a fresh six-month peak earlier in the session.