The U.S. economy added just 22,000 jobs in August, and prior months were revised lower again, signaling a recession may have already started.

“It’s clear the job market is struggling,” Mark Zandi, chief economist at Moody’s Analytics, told Fortune. “The economy is on the edge of recession: in fact, we may already be in one. As more revisions come in, it will probably show that employment is declining in a consistent way.”

The weak August tally followed downward revisions to prior months. June was restated to show a net job loss of 13,000—the first decline since 2020—while July’s gain was nudged higher, leaving overall employment 21,000 lower than previously reported.

Zandi called the June loss especially significant: “Historically, when recessions are dated, they’re dated back to the first month of payroll declines. That would suggest that if we are going into recession, it began in June.”

The weak showing reinforces a picture of a labor market that has almost entirely lost momentum. Hiring in health care and social assistance provided a modest boost, but it was largely offset by declines in federal government payrolls and a continued weakness in energy and manufacturing sectors.

A strike in the transportation equipment sector alone erased about 15,000 factory jobs, the BLS said in its report. Wholesale trade also shed workers.

Despite the slowdown, layoffs remain subdued, a dynamic Zandi described as a “firewall” holding back a deeper downturn.

“Businesses haven’t panicked yet,” he said. “It’s just that they’ve turned more cautious in their hiring. That firewall between a stalling economy and a recession hasn’t been breached, but it’s very, very close.”

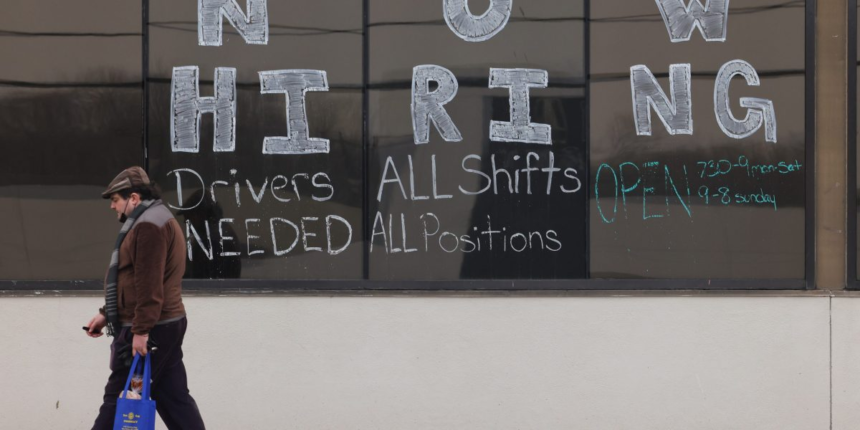

Cooling labor market

The cracks in the labor market are becoming harder to ignore. Long-term unemployment has ticked higher over the past year, and more than 6 million people outside the labor force now say they want a job, up from roughly 5.7 million about a year ago, according to the BLS.

“This really feels like a jobs recession,” Zandi said. “Employment is flat to down. Output and incomes are still growing, but the economy is incredibly vulnerable. Nothing else can go wrong, or it could tip us into a full downturn.”

Fed Independence

Zandi warned that the stakes for the Federal Reserve go beyond managing inflation and growth.