This Content Is Only For Paid Member

John Hess, the son of Hess Corp founder Leon Hess, has agreed to sell the U.S. oil producer to Chevron Corp in a deal worth approximately $5 billion. The deal marks the end of a 90-year journey that began during the Great Depression when Leon Hess started the company with a secondhand truck delivering fuel oil.

The family’s stake in Hess Corp, which includes shares held by family members and trusts, amounts to 29.2 million shares, as per the latest proxy filing. However, over 25 million of these shares are associated with trusts, the Hess Foundation, limited partnerships, and limited liability companies, potentially not all beneficially owned by the family.

Chevron’s all-stock acquisition of Hess values the oil independent at $171 per share, reflecting a significant development in the oil industry.

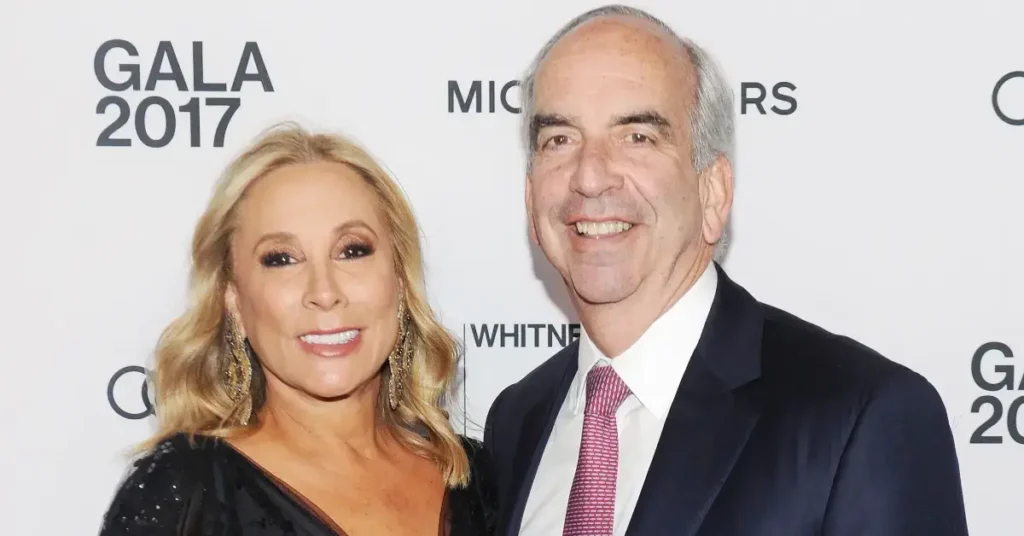

John Hess, the current CEO of Hess Corp, who has held the position since 1995, is set to join Chevron’s board once the deal is completed. He has confirmed that he has no intention of selling down his family’s stake, which is expected to become one of Chevron’s largest holdings.

Speaking on a conference call following the announcement of the takeover, Hess emphasized their commitment to the deal, stating, “We still get to participate in the upside. This value accretion will go to Chevron shareholders, of which I and my family are going to be one, and intend on holding the stock for a long time.”

As part of the agreement, Hess shareholders will receive $6.50 per share in dividends in the year following the deal’s closure, a significant increase from the current $1.75 per share.

This transaction reflects a significant shift in the landscape of the oil industry and marks the end of an era for the Hess family, who played a pivotal role in the company’s history and growth.