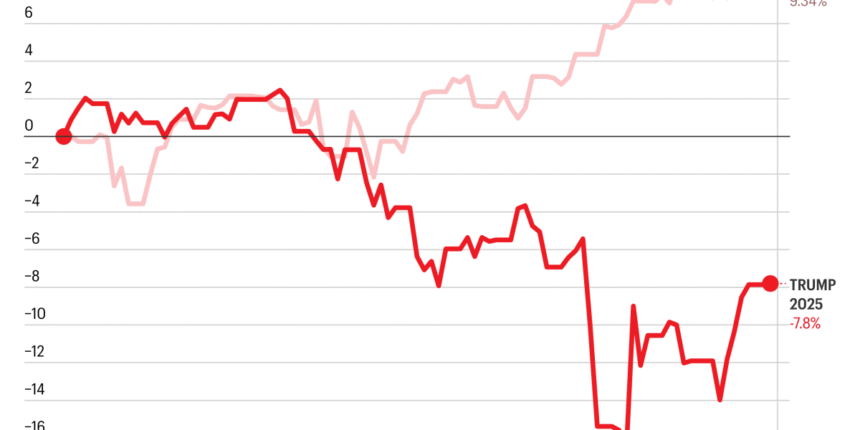

President Donald Trump’s first 100 days in the White House have been historically bad for the stock market.

From January 20 to late April, the S&P 500 has dropped almost 8%. That’s the worst start to a presidential term since Gerald Ford took the reins of the executive branch after Richard Nixon resigned in 1974. And it’s the fifth-worst start since 1928, the earliest date for which S&P Global Market Intelligence has data.

(While the S&P 500 in its current incarnation has only existed since 1957, S&P Global Intelligence has comparable data going back to 1928 from previous stock indices that Standard & Poor has developed.)

The stock market’s lackluster performance under Trump only ranks ahead of the starts of Franklin D. Roosevelt’s terms in 1933 and 1937, during the depths of the Great Depression. It also outstrips both Ford and the start of Nixon’s second term in 1973, when the U.S. confronted another economic crisis in the form of stagflation.

“The U.S. stock market and the dollar have fared worse over the last hundred days than they fared during the first hundred days of all other presidential terms since 1980,” John Higgins, chief markets economist at Capital Economics, wrote Monday in a research note titled, “Surely the next 100 days won’t be as turbulent as the last?”

Meanwhile, in the first 100 days of Joe Biden’s turn in the Oval Office, as global markets rebounded from the damage inflicted by COVID-19, the S&P 500 jumped more than 9%. That ranks as the third-best start for a commander-in-chief since 1928.