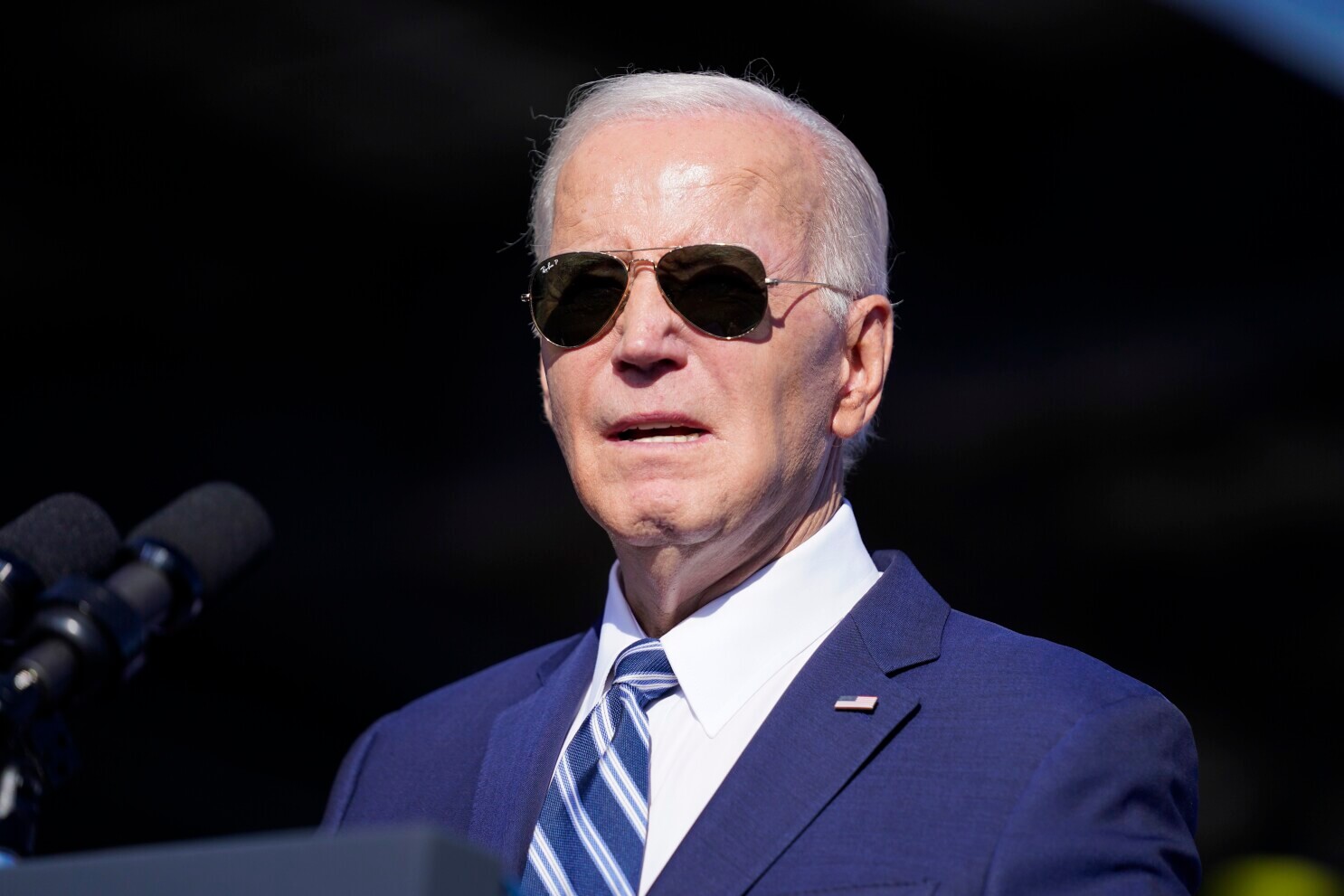

President Joe Biden recently revealed the selected locations for seven regional hydrogen hubs, set to receive a substantial $7 billion investment from the government as part of the bipartisan infrastructure law passed by Congress in 2021. This allocation was made in line with the Regional Clean Hydrogen Hubs program, aimed at supporting the development of 6 to 10 regional clean hydrogen hubs across the United States. These hubs constitute a significant part of Biden’s ambitious climate goals, with a commitment to reducing the country’s greenhouse gas emissions by 50% to 52% below 2005 levels by the year 2030. The hydrogen produced in these hubs will be sourced from renewable energy, natural gas, and nuclear energy.

President Biden emphasized the role of hydrogen in achieving the goal of achieving net-zero emissions by 2050, stating that hydrogen can power critical industries like steel and aluminum production while transforming the transportation sector. He emphasized that hydrogen serves as an essential complement to renewable energy sources like wind and solar, particularly for hard-to-decarbonize sectors such as heavy industry, long-haul trucking, and shipping.

The seven designated hubs are expected to generate a collective output of 3 million tons of hydrogen annually, contributing to the Department of Energy’s (DOE) national target of 10 million tons of hydrogen production by 2030. An estimate by a senior administration official suggests that these hubs will help reduce the country’s carbon dioxide emissions by approximately 25 million metric tons annually, which is roughly equivalent to removing 5.5 million gasoline-powered cars from the road.

The DOE’s $7 billion investment will be matched by awardees, resulting in a combined cost-sharing amount exceeding $40 billion.

Hydrogen Stocks and Market Reaction

Despite this substantial investment in hydrogen hubs, the stock market’s response has been rather underwhelming. Hydrogen-related stocks saw minimal movement in Monday’s trading session. For instance, shares of Plug Power Inc., a leading hydrogen fuel cell manufacturer, increased by just 0.14% at 1:00 PM Eastern Time, despite the company’s announcement of expected revenues of around $6 billion by 2027 and $20 billion by 2030. These figures significantly surpass the company’s earlier estimate of approximately $1.2 billion for 2023 revenue and the $1.28 billion consensus estimate among analysts.

Notably, Plug Power has secured a substantial contract to supply a 550 MW electrolyzer to Fortescue Metals for the proposed Gibson Island project in Australia and has been chosen by Arcadia eFuels to provide a 280 MW proton exchange membrane electrolyzer system for sustainable aviation fuel production at Arcadia’s Vordingborg plant.

Plug Power is part of the Appalachian Hydrogen Hub (ARCH2), which spans West Virginia, Ohio, Kentucky, and Pennsylvania and was granted $925 million. Other partners in ARCH2 include CNX Resources Corp., Dominion Energy, Empire Diversified Energy, EQT Corporation, MPLX LP, and TC Energy Corp.

Plug Power is also a participant in the Midwestern Hydrogen Hub, covering Illinois, Indiana, and Michigan, and set to receive up to $1 billion in DOE funding.

Meanwhile, Ballard Power Systems’ shares saw a less than 1% increase, while FuelCell Energy’s stock dropped by 4.6%. These companies are not affiliated with any of the seven selected hubs.

In contrast, shares of Bloom Energy increased by 8.7% as the company is part of the Mid-Atlantic Hydrogen Hub, encompassing Pennsylvania, Delaware, and New Jersey, and will receive up to $750 million. Other companies in this hub include Air Liquide, Chesapeake Utilities, and Enbridge Inc.

Challenges Faced by Hydrogen Tech Companies

Despite the promise of hydrogen as a clean energy source, limited adoption and high costs continue to pose significant challenges for hydrogen tech companies. These firms must grapple with substantial research and development expenses as they strive to enhance their fuel cell technologies. Furthermore, manufacturing and production costs are considerable as they scale up their operations.

Big Oil’s Involvement

Notably, major energy companies like Exxon Mobil Corp. and Chevron Inc. will also partake in Biden’s hydrogen initiative through the Gulf Coast Hydrogen Hub, which is centered in the Houston, Texas region and has received a $1.2 billion award. This hub will engage in large-scale hydrogen production using both natural gas with carbon capture and renewables-powered electrolysis.

Exxon’s CEO, Darren Woods, previously caused a stir when he claimed that the company’s newly formed Low Carbon business has the potential to outperform its legacy oil and gas business, potentially generating hundreds of billions in revenue over the next decade.