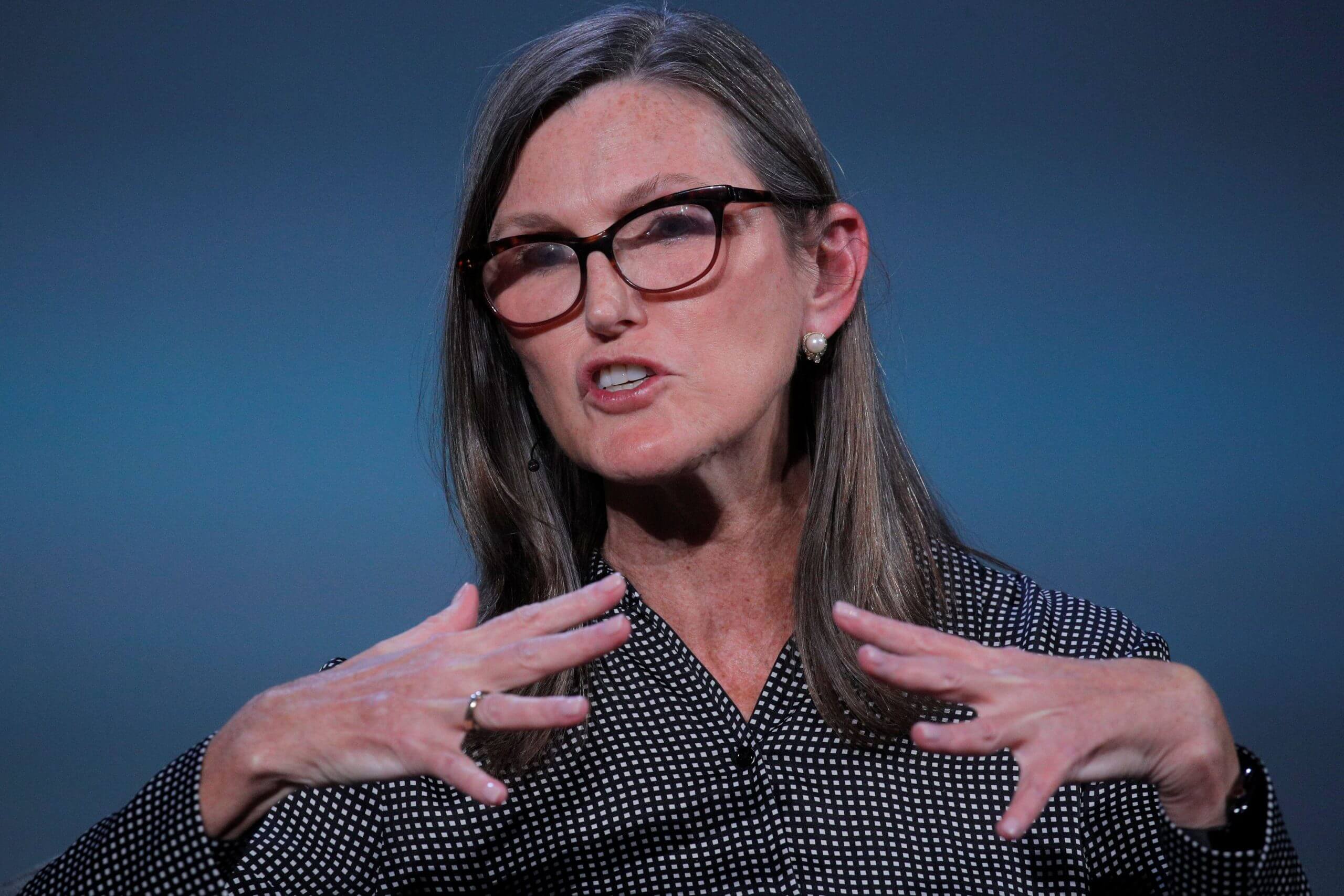

Renowned investor Cathie Wood, head of Ark Investment Management, has garnered significant attention in the financial world, often compared to luminaries like Warren Buffett for her investment prowess.

Dubbed “Mama Cathie” by her followers, Wood rose to fame with an impressive 153% return in 2020, coupled with her articulate presentations of her investment philosophy across various media platforms.

While her flagship Ark Innovation ETF (ARKK) with $8.1 billion in assets has delivered a respectable 30% return over the past year, her longer-term performance has been less impressive. With annualized returns of negative 27% over three years and a modest 2% over five years, Wood falls short of her goal of achieving at least 15% annual returns over five-year periods, especially when compared to the S&P 500’s robust performance.

Wood’s investment strategy revolves around targeting young, high-tech companies in sectors such as artificial intelligence, blockchain, DNA sequencing, energy storage, and robotics, which she views as transformative for the global economy. However, the volatility inherent in these sectors often leads to rollercoaster rides for Ark’s funds, as Wood frequently adjusts her portfolio holdings.

Despite her popularity, not all analysts are convinced of Wood’s approach. Morningstar analyst Robby Greengold criticizes Ark Innovation ETF’s ability to navigate the complex terrain it explores, citing middling total returns and extreme volatility since its inception in 2014. Greengold questions Wood’s reliance on instincts over a more traditional investment approach and highlights the high uncertainty surrounding the future of the stocks in Ark’s portfolio.

Wood has defended her strategy, dismissing critics like Morningstar and emphasizing the evolving nature of technology that defies traditional sector classifications.

In recent trades, Ark funds have sold over 5,000 shares of semiconductor and artificial intelligence giant Nvidia (NVDA), worth $4 million as of Monday’s close. Additionally, Wood purchased 182,000 shares of a distressed tech stock, signaling her continued active management of Ark’s portfolio.