In just the first twenty-four days of 2024, the S&P 500 has surged beyond Wall Street’s consensus projections for the year’s end. Fueled by advancements in Nvidia Corp. and Microsoft Corp., the world’s most closely watched equity benchmark is on an upward trajectory in Wednesday’s trading session. After five consecutive sessions of gains, the S&P 500 has exceeded 4,867, surpassing the average level predicted by Bloomberg survey respondents for eleven months ahead.

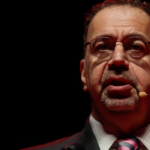

Veteran stocks analyst Ed Yardeni is among those expressing unease about the rapid pace of this surge, building on last year’s 24% rally primarily driven by valuation expansion. Despite Yardeni’s year-end forecast of 5,400 (versus the current 4,888), the speed of the advance raises concerns, especially considering the potential for a tech-led meltup similar to the late 1990s.

Yardeni, the founder of Yardeni Research Inc., highlights the worry of irrational exuberance pushing valuations higher, potentially inflating a speculative bubble in the stock market. While valuations and retail-investing activity suggest a stronger foundation for this equity advance, caution is mounting among analysts.

The current bullish market momentum is catching investing professionals off-guard, reminiscent of last year’s sudden revival in risk appetite across various assets. Despite concerns of a potential bubble, current stock valuations appear less extended compared to three years ago, with technology firms generating profit growth on a trajectory similar to price action.

The seven largest tech firms, including Apple, Alphabet, Amazon.com, Meta Platforms, and Tesla, trade at 49 times profits, which seems expensive compared to the S&P 500’s average P/E ratio of 17. However, these valuations are relatively tame compared to the late 1990s bubble era.

Optimism over potential Federal Reserve interest-rate cuts and a rebound in corporate earnings has fueled the latest market surge. The market’s resilience is evident despite geopolitical tensions and concerns about a potential economic downturn following the Fed’s aggressive rate hikes.

While the lack of enthusiasm among Wall Street prognosticators initially led to projections calling for a modest 1.3% rise in the S&P 500 in 2024, the market has already exceeded these targets. Hedge funds are returning to tech megacaps, indicating renewed confidence in the industry’s leadership in the new year.

Despite reservations and concerns, the market’s current move is seen as a blend of euphoria and FOMO (fear of missing out). As the year progresses, the question remains whether companies can meet the high expectations being priced in by the market.