Nvidia’s report, due after the market closes, has turned into a pulse check on an AI boom that began three years ago when OpenAI released ChatGPT. That breakthrough transformed Nvidia from a mostly under-the-radar chipmaker — best known for making graphics chips for video games — into an AI bellwether because its unique chipsets have become indispensable for powering the technology underlying the craze.

“Saying this is the most important stock in the world is an understatement,” Jay Woods, chief market strategist of investment bank Freedom Capital Markets.

But in the past few weeks, more investors are starting to wonder if the AI craze has been overblown, even as Big Tech companies like Alphabet increase their budgets for building more AI factories. That’s why Nvidia’s market value has fallen by more than 10% — a reversal known as a correction in investors’ parlance — just three weeks after it became the first company to be valued at $5 trillion.

“Skepticism is the highest now than anytime over the last few years,” said Nancy Tengler, CEO of money management Laffer Tengler Investments.

Despite the recent worries, it’s widely assumed that Nvidia’s quarterly numbers will at least mirror the analyst forecasts that steer investor reactions. The Santa Clara, California, company is expected to earn $1.26 per share on revenue of $54.9 billion, which would be a 59% increase from the same time last year.

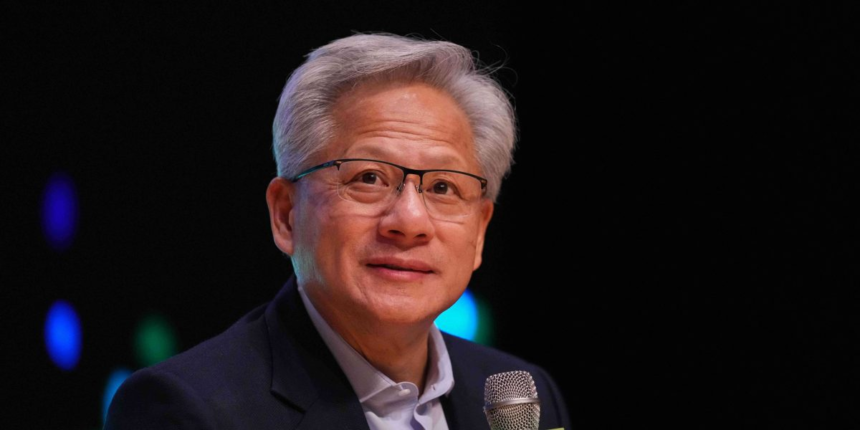

But the bar has been raised so high for Nvidia and AI that the company will likely have to deliver even more robust growth to ease the bubble worries. Investors also are likely to be parsing Huang’s remarks about the past quarter and the current market conditions — an assessment that has become akin to the State of the Union for the AI boom.