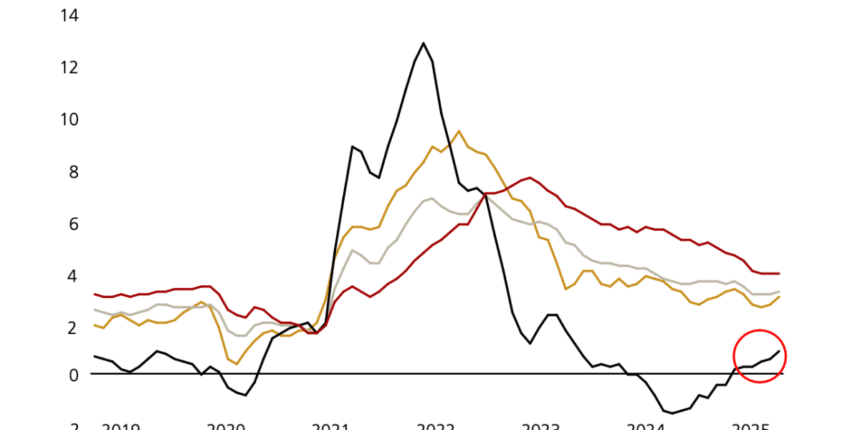

Headline U.S. inflation jumped to 2.7% in June, its steepest rise in five months, according to the latest consumer price data. UBS Global Wealth Management took a look under the hood, writing in its monthly letter that “it’s quiet … a little too quiet.”

Chief investment officer Mark Haefele appealed to the cinephiles in his audience: “Movie fans will know that feeling of tension when the hero steps into supposedly dangerous new territory only to find nothing there.” The TACO traders are waiting for the next shoe to drop, tariffs are at their highest since the 1930s, and the Federal Reserve’s independence is threatened, he writes. Yet global stocks are at record highs, rate volatility is down, and credit spreads are tightening.

A central question remains on tariffs: Who pays for them—exporters, importers, or consumers? Haefele cautions that it’s unclear how exporters, importers, or consumers will divide the economic costs. The split will likely differ by industry, product, and market position.

Some fiscal offsets may be on the way. The recent “One Big Beautiful Bill,” which contains extended and new tax cuts—partly funded with tariff revenue—could help stimulate the economy. But the amount of that revenue is unclear.

Risks tilt in both directions. If tariffs fuel a larger-than-expected inflation surge, consumer spending may slow and the Federal Reserve could be forced into a tough policy corner, balancing price stability against economic growth. Alternatively, if companies absorb more costs to maintain market share, profits could slump, further weighing on investment and labor markets.

For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.