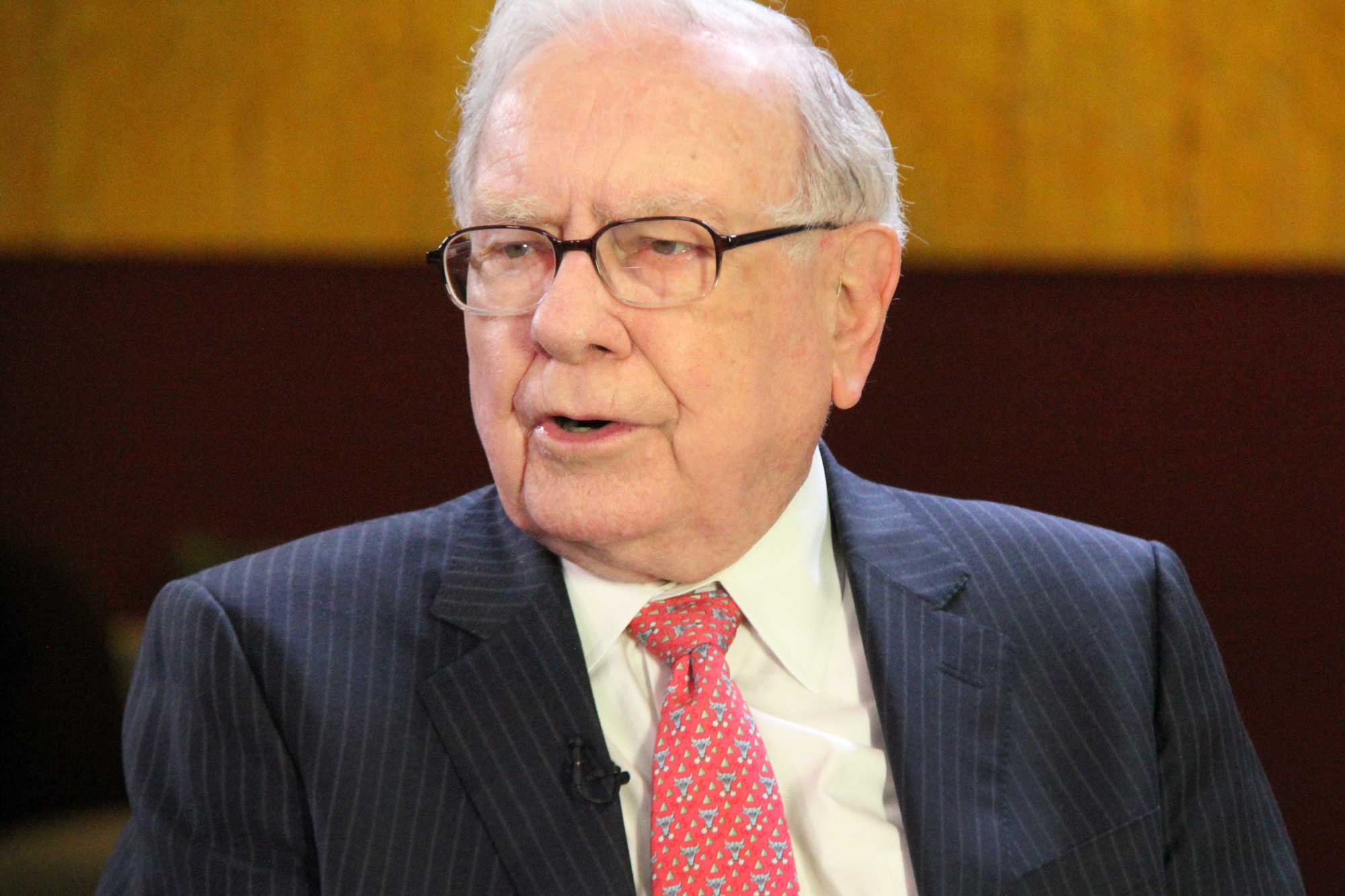

Warren Buffett, Chairman and CEO of Berkshire Hathaway Inc., is renowned for his investment wisdom, but there’s one missed opportunity that still stings: his decision not to invest in Amazon.com Inc. during its early days.

Buffett candidly admits, “I blew it” regarding his choice to pass on Amazon, not once, but twice. In 1994, when Amazon was in its infancy as an online bookstore, Buffett decided against an investment. The same happened in 1997 when Amazon went public, a period when even Wall Street was skeptical about the success of an online initial public offering (IPO). For a brief moment, doubts seemed justified as the stock’s value dipped below its IPO price in 2001-2002.

Despite these missed opportunities, Buffett holds Amazon’s Founder, Jeff Bezos, in high esteem, recognizing him as “an extraordinarily clear thinker as well as a brilliant thinker.” However, Buffett’s reluctance to invest in Amazon stems not from skepticism about the company’s potential but from his investment philosophy. He acknowledges that the “miracle” of Amazon’s growth deterred him from investing, stating, “If I think something is going to be a miracle, I tend not to bet on it.”

Buffett’s decision not to invest in Amazon wasn’t a judgment of the company’s potential but a reflection of his investment philosophy. He once stated, “I was too dumb to realize what was going to happen.” Known for his cautious and methodical approach, Buffett has expressed his regrets to CNBC, recognizing that his reservations have deep psychological roots.

“I’ve probably got so many psychological problems with the fact that I didn’t do it that it’s tough to do it now,” he conceded.

Each Amazon annual report served as a reminder of what could have been, particularly because Jeff Bezos included his original 1997 shareholder letter in them. Buffett admits, “I knew he would do the most with whatever idea he had. I had no idea it had this potential. I blew it.”

While Warren Buffett may have missed the opportunity with Amazon, he doesn’t consider it a failure in his investment approach, but rather in his execution. It serves as a reminder that in the investment landscape, there are various paths to follow. Some, like Buffett, opt for proven and steady investments, while others chase the next groundbreaking innovation, willing to take higher risks for potentially higher rewards. For instance, investing in startups offers the enticing prospect of getting in on the ground floor of the next Amazon or Apple Inc. These high-risk, high-reward scenarios can be appealing to those seeking rapid growth, in contrast to Buffett’s typically long-term strategy.

Investing is a realm where hindsight provides clarity, and even seasoned investors like Buffett acknowledge that not all decisions will yield exceptional results. His choice to bypass Amazon serves as an educational tale: While investment opportunities are plentiful, understanding your own preferences and risk tolerance is the most valuable asset when deciding where to invest.